Virus, we don’t care about no stinking virus! After AAPL warned of substantial impacts creating a selloff, the bulls seem to have regained control as even AAPL rallied by the end of the day. China’s media censorship has mainstream news outlets like CNBC questioning the validity of reports out of the region as three Wall Street Journal reporters were expelled from the country today. No price seems to high for some tech companies as the push for record highs continues. Don’t bother us with warnings; we want a 30,000 Dow!

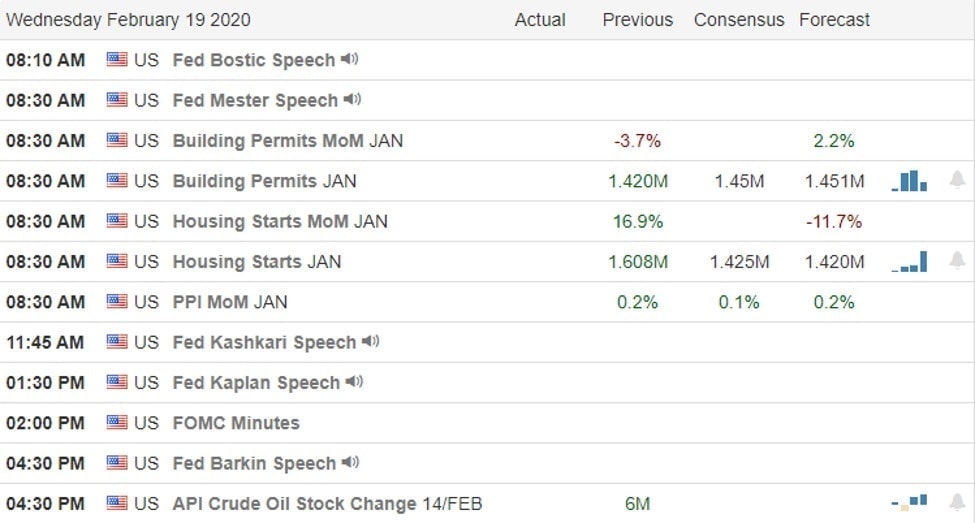

Asian markets closed mixed but mostly higher overnight, and European markets are green across the board this morning. US Futures opened bullish last night and stayed the way all night currently pointing to a bullish open ahead of a big day of earnings reports and the release of the FOMC minutes at 2 PM Eastern today. Continue to expect news-driven reversals and the possibility of big overnight gaps as the outbreak uncertainty warnings continue to come out despite the willingness of the market to ignore them.

On the Calendar

On the Hump Day earnings calendar, we have a big day with nearly 190 companies reporting. Notable reports include SAM, ALB, CAR, BHC, ARPN, FUN, CAKE, CDE, DISH, ET, ETR, FVRR, FOSL, GRMN, GPC, HST, H, NTES, OC, PXD, O, STMP, VIPS, WMB, & ZG.

Action Plan

After a selling pullback after AAPL warned of substantial virus impacts, the bulls seemed to regain control by the close. Even AAPL itself rallied by the end of the day as the bulls choose to ignore company warnings. Jaguar and Land Rover said they only have about 2-weeks of parts left, and Adidas warned this morning that their business activity in China dropped 85%. With confirmed cases continuing to rise, futures markets have traded in the green all night long. Three Wall Street Journal reports have been expelled from Chiana as the government censorship of the news clamps down tighter to control the narrative.

If the market wants to ignore and push higher all, we can do as traders is to continue to follow the price action. However, we should be very careful not to over-trade and take profits quicker because of the possibility of large morning gaps, and news-driven reversal risk remains very high. Several big tech stocks have moved into parabolic patterns as it seems traders have decided that no price is too high to pay for market leaders. A condition that’s very reminiscent of the tech run-up in 1999. Choose your trades wisely and avoid chasing stocks at or near resistance or those already several days up in their current run.

Trade Wisely,

Doug

Comments are closed.