The ability to ignore the impacts of the virus impacts shifted to pure panic over the weekend with world markets selling off dramatically. A common reaction for traders is to join in the panic or assume its an over-reaction and rush in to buy the dip. Today we should expect violent whipsaws in the stock and index prices, creating very dangerous conditions for even the most experienced traders. The emotional price swings may not respect price support and resistance levels. Stay calm, protect your capital and avoid revenge trading.

Asian markets closed down across the board overnight and European markets are sharply lower with the outbreak spreading across Italy. Although we have a big day of earnings reports the market has now turned its attention to economic impacts and the fear of its rapid spread around the world. Today is a day to exercise discipline, follow your rules, staying calm and focused on avoiding emotional-charged decisions.

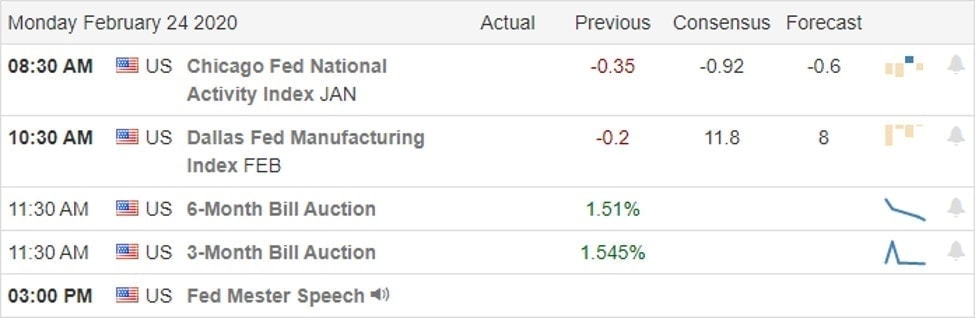

On the Calendar

On the Monday earnings calendar, we have more than 130 companies reporting quarterly results. Notable earnings include AWR, CTB, DDS, DIN, EPR, HTZ, HPQ, INTU, KTOS, OKE, PANW, APTS, RCII, SHAK, & THC.

Action Plan

Friday’s price action raised red flags as the bears became more aggressive, heading into the uncertainty of the weekend. Warning signs continue to grow as safe haven plays such as GLS, SLV, XLU & defensive sector stocks rallied sharply. With news over the weekend that the virus outbreak has spread to 22 countries, fear has quickly shifted to panic overnight as world markets drop dramatically. With oil demand continuing to fall, there is speculation that per barrel oil prices could quickly decline sharply lower. During the night, Dow futures fell more than 800 points but are currently trying to bounce off of those lows though continue to point to painful losses this morning.

Although I sounded like a broken record with daily warnings to not over-trade such an extended market. A market that was choosing to ignore economic impacts turned out to have been the right thing to do. Today will be a very emotional market reaction and a very dangerous day of violent price action and high volatility. Try not to panic and avoid emotional-based decisions. Expect substantial intra-day whipsaws in the market that may not hold at support and resistance levels. This kind of panic environment is dangerous to trade for even the most experienced traders. Protecting your capital is the best course of action and don’t get caught up in the buy the dip crowd or revenge trading because the impact of this outbreak is likely to be far-reaching.

Trade Wisely,

Doug

Comments are closed.