The SP-500 and Nasdaq break through the clouds of uncertainty printing new records while the Dow and Russell close just below key resistance levels. As the bulls relentlessly power forward, China’s Hubei province extends business closures to March 11 and the Commerce Ministry warns of long-term impacts on labor-intensive industries such as manufacturing and food production. Goldman has now added a warning stating a “short-term correction is looking much more probable.” We will soon find out what the bulls think of that these warnings.

Asian markets closed flat to mostly lower overnight, and the European markets are modestly lower or near the flatline this morning. US Futures ahead of the biggest day of earnings reports this week point to a slightly lower open this morning. If all the warnings help the bear engage, watch for an increase in price volatility. However, I would not expect the bulls to give up easily as they work to extend this amazing run.

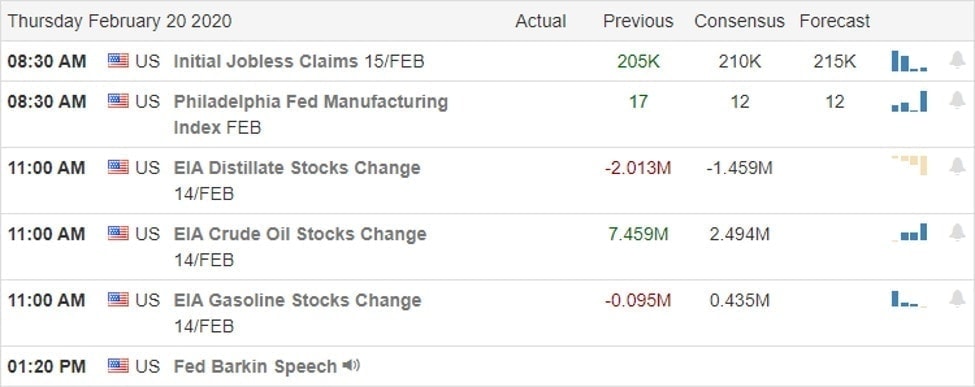

On the Calendar

On the Thursday earnings calendar, we have our biggest day this week, with more than 230 companies fessing up to results. Notable reports include AAN, AKS, AEP, BTD, COG, CLF, ED, CVA, DPZ, DBX, EHTH, ENV, EQM, FSLR, GLPI, GIL, HFC, HRL, I, LAMR, NCLH, PPC, RMAX, SIX, SO, SFM, TXRH, TRUE, OLED, VTR, VIAC, & WIX.

Action Plan

With a mighty bullish push, the SP-500 and the Nasdaq put new record highs in the books. Absolute Breadth Index continues to decline, indicating fewer and fewer companies are supporting the extended rally. Last night Goldman chimed in on the virus economic concerns saying, the market has underestimated the coronavirus impacts with the current stock prices. “While a sustained bear market does not look likely, a near-term correction looking much more probable,” according to Peter Oppenheimer. China’s Hubei province has once again extended business closures to March 11th as they continue to battle to contain the virus spread. The Commerce Ministry in China also warned of possible long-term impacts on key sectors such as labor-intensive industries.

While the SPY and QQQ broke out of the clouds to blue skies yesterday, the DIA and IWM closed the day just below key resistance levels. Trends remain very bullish, and there seems to be no price too high on several tech giants as buyers continue to snap them up despite warnings and parabolic price patterns. Traders should guard themselves from overtrading and chasing extended stock prices well above price supports. Ahead of a big day of earnings and economic reports, US Futures appear slightly more cautious this morning after the Goldman warning.

Trade Wisely,

Doug

Comments are closed.