Bearish virus fears and bullish earnings reports will duke it out for control today after a surprising increase in confirmed cases and deaths. The bulls clearly want to ring the 30,000 Dow bell, but this pesky microscopic virus might stand in the way. With the confirmed cases surging to more than 48,000 and an increase of 242 deaths, the likely economic impacts are growing more difficult to ignore. Expect substantial price volatility as the bulls and bear duke it out and remember we now face the uncertainty of a 3-day weekend. At the risk of sounding like a broken record, avoid over-trading and consider your risk carefully.

Asian markets closed down across the board with business closures extended until the 21st. European market are decidedly bearish this morning trading in the red across the board as virus fears rise. US Futures point to a nasty gap down overnight reversal ahead of a big day of earnings and economic data. Fasten your seat-belt; this could be a bumpy ride heading into a long weekend.

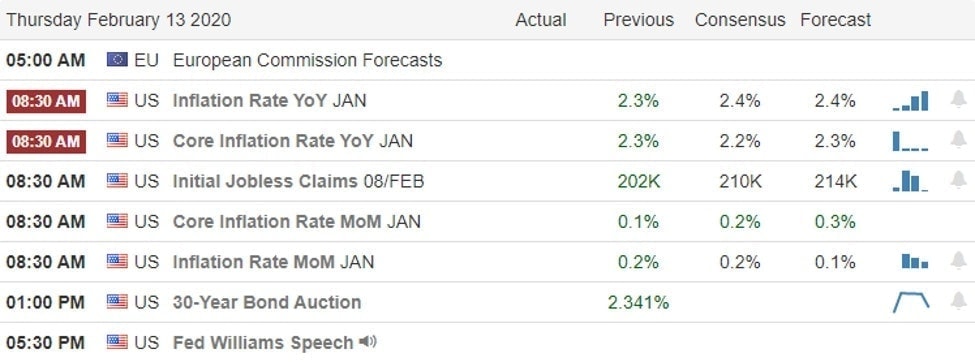

On the Calendar

On the Thursday earnings calendar, we have our biggest day this week, with more than 230 companies fessing up to results. Notable reports include ROKU, NVDA, ANN, AEM, BABA, AIG, AVP, BAM, CC, DLR, DISH, EXPE, FTS, GNC, GDDY, IRM, KHC, LH, MANU, MAT, PEP, R, SSTK, TRUP, WM, WH, AUY, YELP, YETI, & ZTS.

Acton Plan

Although a very big day of earnings reports, the market is facing a nasty overnight reversal this morning as the virus outbreak comes back into focus. China said it confirmed more than 15,000 new cases and 254 additional deaths bring the death toll to more than 1300. Total cases now exceed 48,000. Global oil demand expects to see it the first quarterly decline in over 10-years as a result of the outbreak. Hubei province once again extended business shutdowns to Feb, 21, and Hong Kong extended school closures for the 3rd time in the virus battle. One has to wonder with this huge surge in confirmed cases and a 3-day weekend just around the corner if the fear of uncertainty will begin to encroach on the unbridled bullishness of late.

After the bell yesterday, AMAT made investors cheer with stock leaping nearly 3% but NTAP and CSCO disappointed with share prices dropping 12% and 4.5% respectively. Before the bell today, BABA reports, and it will be very interesting to find out if the outbreak helped or hurt the huge online retailer. Overnight reversals such as the one we face this morning are not only damaging to those unprepared but also brings the possibility of a big emotional response. Remember it was only 10-days ago when the Dow dropped 600 points on virus fears. I have to wonder what kind of reaction could be possible after rallying more than 1200 points in 9-days as we approach the uncertainty of a 3-day weekend. Expect significant price volatility in the days ahead.

Trade Wisely,

Doug

Comments are closed.