With an ugly whipsaw in price action, the bears reminded us yesterday they are still here, and like it or not, this rally will not go up forever. A rude awakening for traders overtrading or chasing already extended stocks. Overnight we learned of outbreaks in China prison populations, South Korea and Iran, while Japan extended business closures. As we head into the weekend, it will be interesting to see if the uncertainty will bring out the profit-takers or if bulls will continue to buy despite the economic warnings. No matter which side wins the day, I suspect price volatility will add significant complexity to the decisions ahead.

With new outbreaks in both men and women prison populations, Asian markets closed the week mixed but mostly lower. European markets are improving as the morning goes on but are modestly in the red across the board. US Futures are also coming off morning lows ahead of economic and earnings reports but continue to point to a modestly bearish open. Plan your rick into the uncertainty of the weekend very carefully as the economic impacts continue to grow.

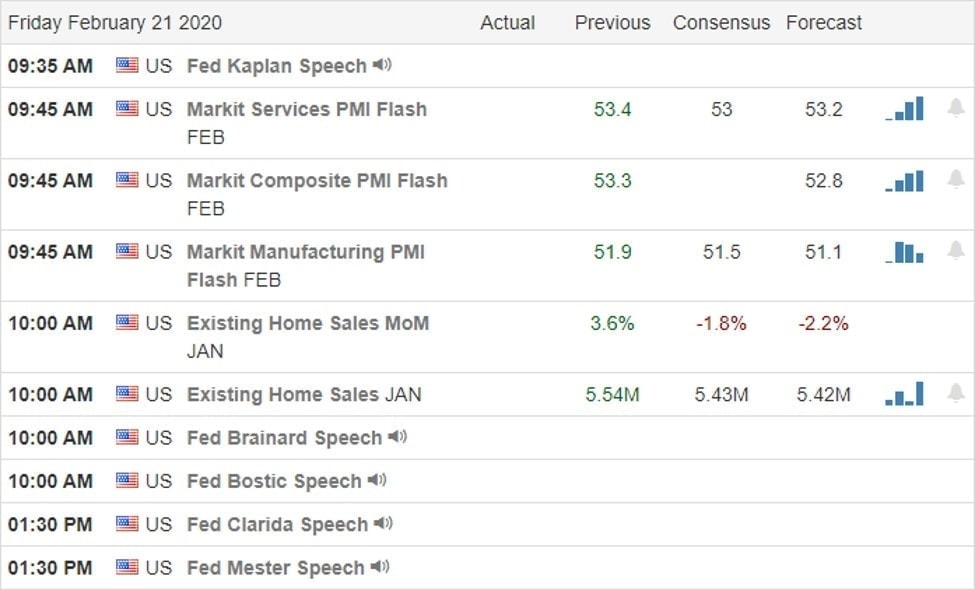

On the Calendar

On the Friday earnings calendar, we get a little break with less than 60 companies reporting quarterly results. Notable reports include B, CNK, DE, ERF, MGA, RY & WPC.

Action Plan

A wild day of price action yesterday gapping lower on after a warning from Goldman but quickly rallying back up to price resistance. After banging against the resistance several times, the bears launched a strong attack with the Dow plunging more than 300 points, then reversing once again trimming losses to just 128 Dow points. A guy could get whiplash with that kind of price action! During the night virus fears seemed to grow as Japan extended business closures and outbreaks expanded in South Korea and Iran. Hundreds of new confirmed cases were reported in China last night with an outbreak in prison populations of both men and women.

The big recovery yesterday left behind a bunch of Hammer Candle Patterns at or near price support levels, likely adding hope of a rally for today. Unfortunately, fears of new outbreaks have markets around the world under some selling pressure this morning. It will be interesting to see if the uncertainty of the weekend will inspire the bears to reengage or if the bulls will continue to have the willingness to ignore the future economic impacts. Although redundant, I will continue to warn about overtrading and to plan your risk carefully heading into the weekend. Yesterday’s wild price action may have been a warning shot over the bow that more volatility is close at hand.

Trade Wisely,

Doug

Comments are closed.