Respect the bears!

Yesterday we were reminded that no matter how much the government spends in stimulus or the trillions injected by the Central Banks, traders must always respect the bears! In this incredibly emotional feast or famine market, the daily overnight institutional overnight gaps have become very wearisome. Unfortunitually it appears to be the new normal, and we should expect the wild volatility to continue as we head toward the uncertainty of the weekend.

Asian markets closed the week lower across the board but managed to recover a substantial amount of the early losses. European markets are bullish across the board this morning but continue to fluctuate as the attempt to recover from another round of pandemic worries. US Futures have also seen substantial volatility this morning but continue to point to a sizeable overnight gap up as we grapple with a resurgence of coronavirus infections and hospitalizations. Buckle up, as it could be another wild rise as we slide into a weekend of unknowns.

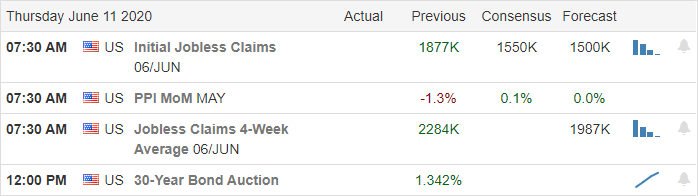

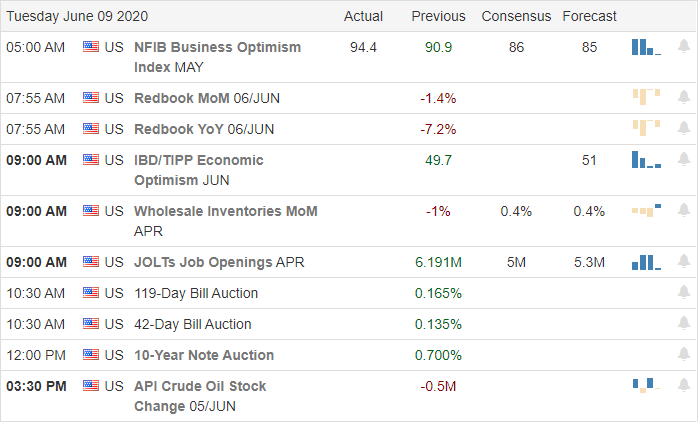

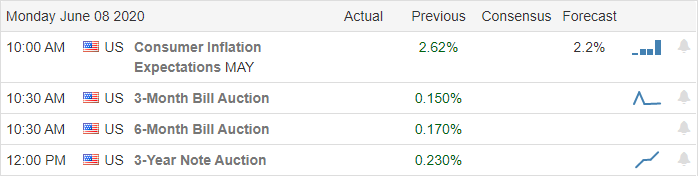

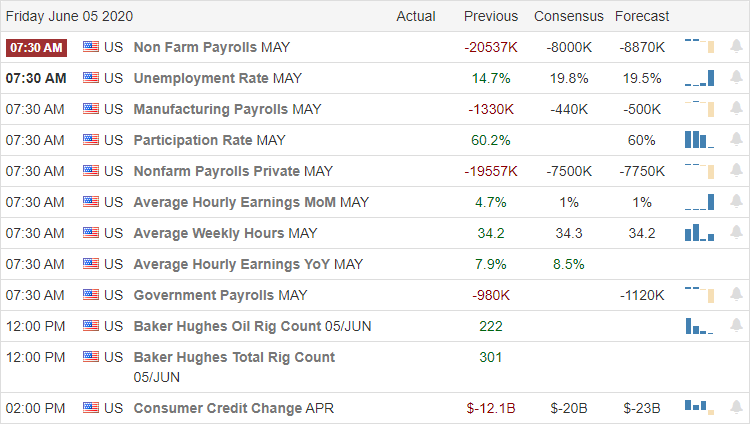

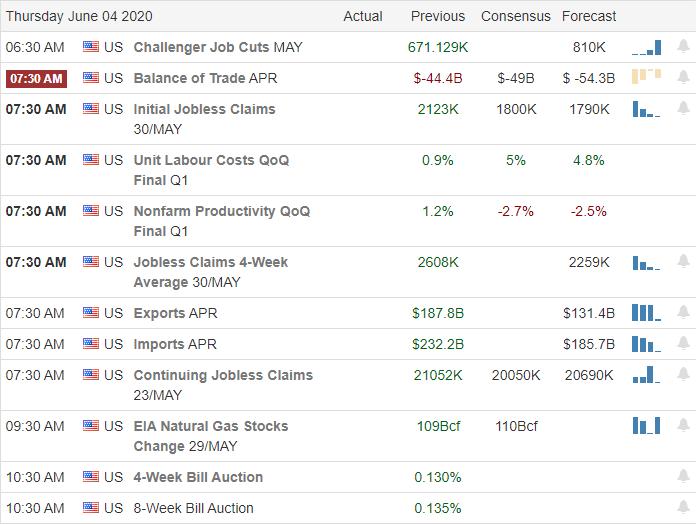

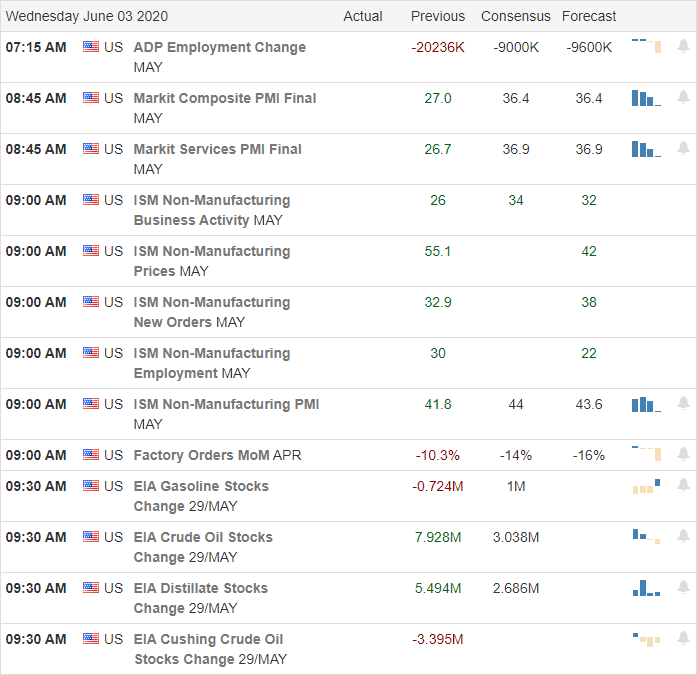

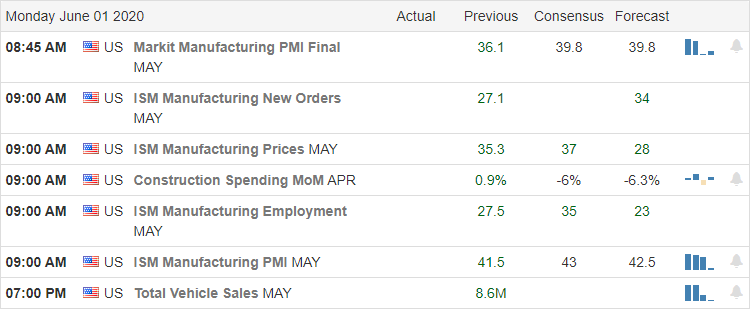

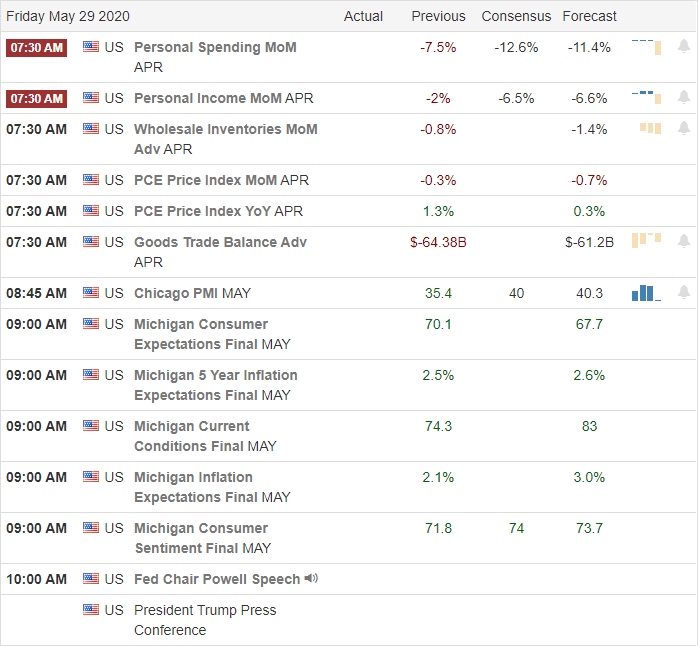

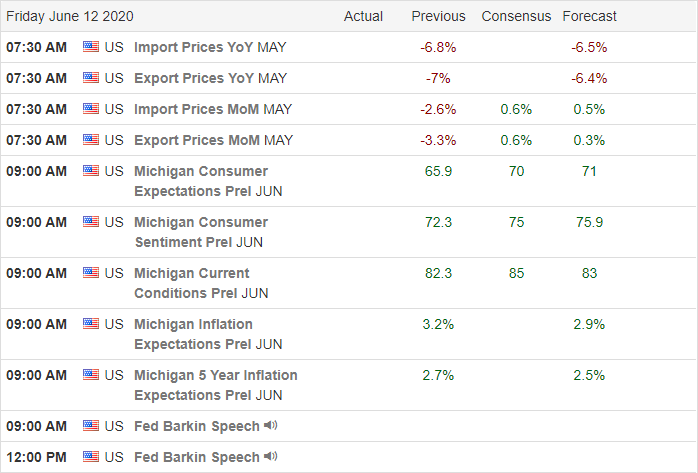

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have 30 companies reporting quarterly results. Looking through the list, I can only find one particularly notable report, that being PRTY.

Technically Speaking

Yesterday we were reminded that we must never forget that the bears and always have a plan to protect our capital if they launch an attack. For some time, there have been clues that the market was extraordinarily overextended, but if you are like me, you’ve grown weary of the overnight institutional gaps. However, it has become the new normal in this all or nothing, feast or famine market. Today looks to begin similarly, but this time a substantial overnight gap up. With coronavirus cases continuing to rise, Arizona announced their hospitals are near capacity. Yesterday’s jobless claims added another 1.5 million unemployed, which is a modest improvement of the prior week but indeed demonstrated just how challenging this economic recovery has become.

Considerable technical damage occurred in the DIA and IWM yesterday as the indexes failed their 200-averages. The Dow is now less than 850 points away from testing its 50-day morning average, and even with today’s big gap up, we should not ignore the possibility that it might see a test in the near future. The SPY is in a much better technical situation having closed at it’s 200-average with the big tech firms providing the majority of the price support. Of course, the QQQ is in the best technical, having only suffered a pullback to test its bullish trend. As we slide into the weekend, expect a considerable amount of price volatility as traders and investors grapple with the uncertainty of the weekend.

Trade Wisely,

Doug