After a bit of morning price volatility, the bulls resumed there march higher despite the jobless number that now affects 1 in 4 working Americans. Then late in the day, the President announced a news conference “on China,” and the bears suddenly woke up, swinging the markets sharply lower into the close. There are very little to no details on what will or will not be said or done in this new conference, so not surprisingly, the market is a bit apprehensive waiting for the next shoe to drop. Also, facing another big day of economic data, traders have a lot to grapple with as we head into the weekend.

Asian markets closed mixed but mostly lower with Hong Kong not surprisingly have the most significant bearish reaction to the new China law. European markets are modestly lower across the board in response to the rising US-China tensions. US Futures point to slightly lower open ahead of several economic reports and more comments from Jerome Powell. Anything is possible, so plan carefully with an uncertain weekend approaching.

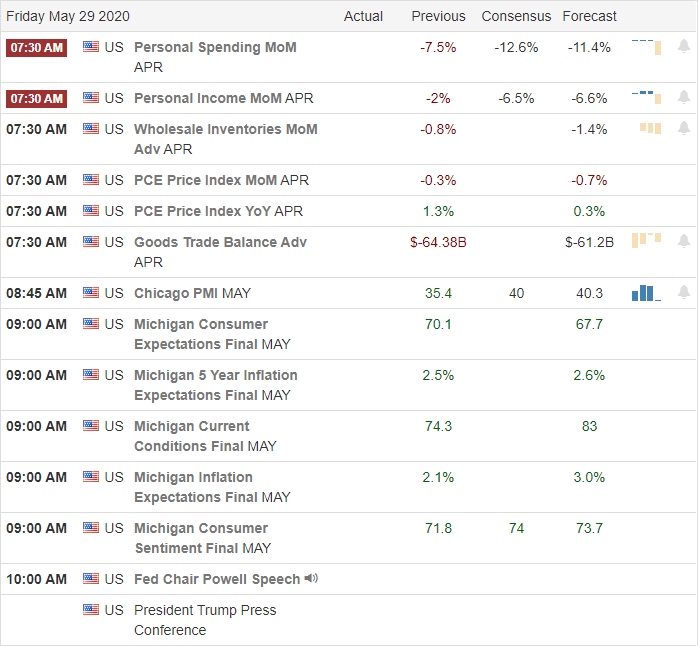

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have 60 companies reporting results today, but looking through the list, we only CGC is particularly notable.

Technically Speaking

After a rather quick pop and drop crating some morning price volatility, the bulls regained control and began a steady climb. After yesterday’s jobless number, we have nearly ¼ of working Americans standing in unemployment lines. However, the market seems to have absolutely no concern about unemployment choosing to focus on the hopes of recovery. Then at the end of the day, the President announced a new conference on China, and suddenly the bears woke up, worried about the uncertainty of what happens next. Countries around the world have including have joined in to chastise China’s new security law. That may be the straw that broke the back of the recent cautious US approach to China. At this time, there are very few details about what may or may not occur during this new conference, so naturally, the market is a bit on edge, making about anything is possible in the day ahead.

Although index trends remained bullish yesterday, price action left behind candle patterns raising the need for a little caution. We also have a busy economic calendar today with International Trade, Personal Income and Outlays, Chicago PMI, Consumer Sentiment, and another speech from Jerome Powell. Consider your risk carefully as we approach a weekend that may include new China-related uncertainties.

Trade Wisely,

Doug

Comments are closed.