Even after last week’s run that lifted the Dow more than 2000 points, the US Futures point to a gap up open led by rallies oil, airlines, and cruise lines. Even as US cases of the virus topped 2 million, the death toll passed 110,000 and, protests keep business shuttered; the NASDAQ set new record highs with a surprise jobs number. As there is no president for such a strong rally, what comes next is anyone’s guess. Just stay focused on price action watching for the clues of profit-taking if a pullback begins.

Asian markets closed up across the board in reaction to rising oil prices. European markets traded mixed this morning with worries about pandemic restrictions and protests that grew violent over the weekend. The US markets are by far the most bullish of current world markets, pointing to a substantial gap up once again.

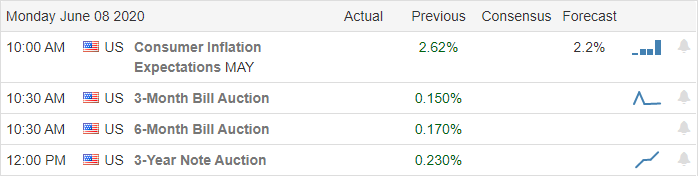

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have a light day with just 24 companies reporting. Notable reports include CASY & SFIX.

Technically Speaking

After last week’s remarkable rally, it would be reasonable to expect a little rest or pullback in the market considering the Dow increased by more than 2000 points. In reaction to the better than expected jobs report, the DIA and the IWM lept well above its 200-day moving averages for the first time since February while the QQQ set new record highs. As world economies begin to reopen Coronavirus cases top 7 million with US cases now over 2 million and a death toll of over 112,000. The UK has implemented a mandatory 14-day quarantine on all that travel into the area; however, British Airways is threatening lawsuits. In reaction to the widespread protesting, the Democrats plan to propose new police procedures and accountability rules. The majority fo the Minneapolis city council has is backing the idea of disbanding the police force entirely.

There is no president in history for this remarkable market rally. The T2122 indicator appears pinned against the ceiling suggesting an extreme short-term overextension. That said, the US futures point to another gap up open with airlines and curse lines leading the way. Oil is surging this morning after OPEC decided to extend the historic production cuts through the summer, which is also helping to boost the futures this morning. What comes next is anyone’s guess, so stay focused on price action and be prepared for the possibility of profit-taking if the bears finally decide to make an appearance.

Trade Wisely,

Doug

Comments are closed.