After a late-session bullish run, the US Futures began to sell off, and the news cycle headlines shifted to something a bit more bearish. A new record daily high in worldwide virus infections, Texas with a record number of COVID-19 hospitalizations, the US officially in recession and headlines of a cold war with China. Things that make you say, hmmm? Those the entered late into the run could feel a bit of pain this morning with yet another morning institutional gap.

Asian markets closed mixed but mostly higher overnight, but European markets are decidedly bearish this morning. US Futures point to a Dow gap down around 300 points ahead of earnings and the kickoff to the 2-FOMC meeting. Expect an extra dose of price volatility at the open.

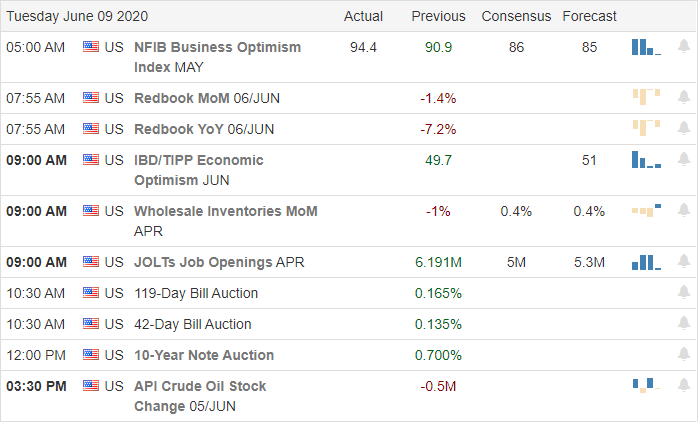

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 39 companies fessing up to quarterly results. Notable reports include AMC, CHWY, CONN, FIVE, GME, HDS, MOV, SIG, VRNT.

Technically Speaking

Almost immediately after the market closed on Monday, the US Futures began to a selloff, and the news shifted to bearish headlines. We learned we are officially in a recession, that Texas now has a record number of COVID-19 hospitalizations, and the world infections hit a new all-time high. According to reports, the US and China entered an economic cold war. China has also invoked the anger of Australia, Canada, Germany, Netherlands, and Sweden in what’s being called “Wolf Warrior diplomacy.” Dow Futures were down about 350 points overnight, but the typical morning pump has begun lifting them well off the lows. I suspect we will see a bit more 2-sided price action increasing the price volatility this morning. The wild card in the mix is the beginning of the FOMC meeting and what we might learn on Wednesday about the committee’s historic buying programs.

In the last 7-market sessions, the Dow has run up nearly 2500, the SP-500 more than 225 and NASDAQ in a 9-day bull run is up a whopping 850 points. Such an enthusiastic bulls run can sometimes lead to a painful pullback as if the carpet is pulled out from underneath, especially for those that entered trades late in the rally. The indexes are so extended that a 50% pullback in the Dow, about 1250 points, would remain in a bullish trend. I am in no way suggesting that will occur! I am only pointing out the potential danger that may exist in such an extended condition. Of course, the new normal is the institutional overnight gap that may leave many retail traders squealing from the feeling.

Trade Wisely,

Doug

Comments are closed.