Gaping up and running ahead of the FOMC announcement, the NASDAQ set new record highs once again. The committee suggested interest rates would remain near zero until sometime in 2022. Still, after the Chairman’s press conference, the bears made an appearance moving the index’s lower with only the QQQ closing the day with gains. Sadly, this morning rug is pulling out with the market suddenly concerned with the rising coronavirus infections and hospitalizations around the country.

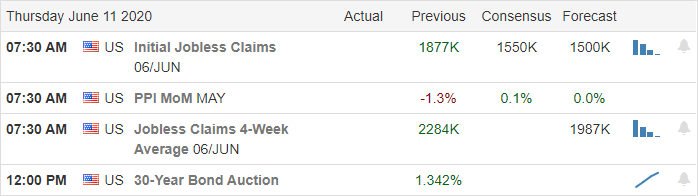

Asian markets closed lower across the board in reaction to the FOMC forecast. European markets are also tumbling this morning by as much as 2.50%. US Futures are plunging this morning and have worsened in the pre-market, suggesting a substantial decline at the open with more jobless data on the way. Expect significant price volatility.

Economic Calendar

Earnings Calendar

On the Thursday economic calendar, we have short of 30 companies stepping up the earnings reporting podium. Notable reports include LULU, ADBE, PLCE, PLAY, & PVH.

Technically Speaking

After a choppy beginning to the week as we waited for the FOMC committee decision, it pretty much turned out to be a non-event. The decided that interest rates would likely remain near 0 until sometime in 2022 and that they will continue appropriate operations to support the economy. The initial market reaction was bullish, but after the Chairman’s press conference, the bears pushed back, closing the index’s modestly lower. This morning according to reports, the market is once again suddenly concerned about the second wave of coronavirus with infection rates that have risen the last couple weeks. There are 9- California counties reporting a spike in new coronavirus cases and hospitalizations. Airlines and cruise lines are sharply lower this morning, and not surprisingly, some retailers also see bear activity.

This morning US Futures point to an ugly gap down of 500 points or more in the Dow. The big question will be the activity in the NASDAQ giants that have seen remarkable bullishness of late and supplied most of the index’s levity. Should stocks like AAPL, AMZN, GOOG, MSFT turn lower, it could a rather harsh pullback could ensue. However, if the bulls can continue to show their tenacity of last couple weeks, the selling could be quickly absorbed, and price support levels defended. Hold on tight; it may be a wild morning with a considerable dose of price volatility.

Trade Wisely,

Doug

Comments are closed.