Bullish overnight gaps and low volume chop through the day seem to have become the new normal in the recovery. The rest of this week, we face a significant economic data dump that is likely to reveal historically ugly numbers, but of late, that has only served to bulls to buy. With the NASDAQ easily within striking range of new record highs, I suspect no matter the numbers; we see the tech sector breakthrough this week.

Asian markets closed the day green across the board as optimism of reopening brings out the bulls. European markets also advance as they keep an eye on rising US/China tensions. Ahead of earnings and economic reports, the US Futures see nothing but green pointing to yet another gap up at the open.

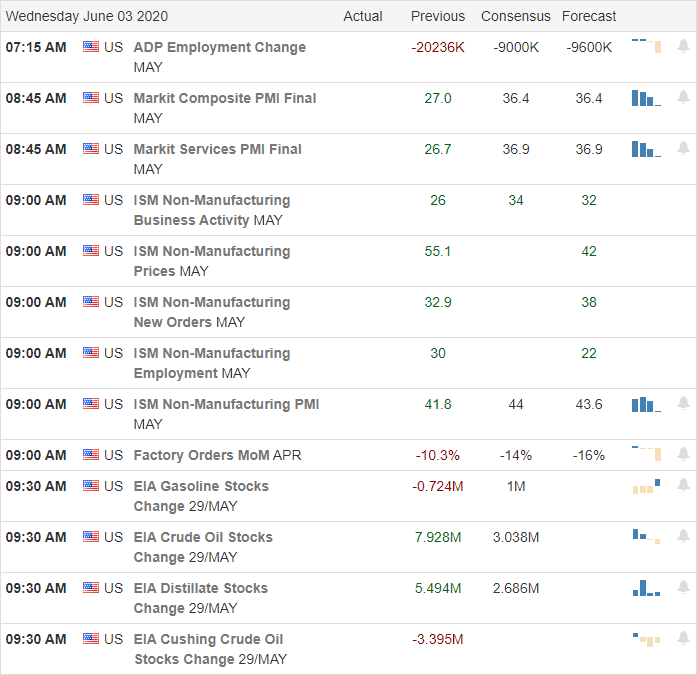

Economic Calendar

Earnings Calendar

On the Hump Day calendar, we have less than 40 companies reporting their quarterly results. Notable reports include CPB, AEO, CNK, & GWRE.

Technically Speaking

The new norm for the market seems to be a big overnight gap and grind sideways throughout the day with choppy price action with low volume. Today the futures are pointing to the same bullish gap up open as the bulls near new record highs in the Nasdaq. There was widespread protesting across the nation yesterday afternoon and during the night, but thankfully the majority of the demonstrations were peaceful. Sadly the Pentagon has moved troops into DC to protect the public and defend businesses from looting. In California, the police have taken over Jackie Robinson Stadium to using it as a temporary field jail. Oil price continued to rise yesterday, hitting 3-month highs on expectations OPEC plans to extend the deepest production cuts in history in response to record low demand due to COVID-19 restrictions. Considering we still have a Presidental election to deal with and a possible resurgence of the virus this fall 2020 may continue to provide challenging price volatility and uncertainty for the foreseeable future.

The bulls are clearly in control, and the trillions of stimulus and central bank operations have sent the bears into summer hibernation. With the NASDAQ so close to making new record highs, it would be shocked if the institutions didn’t continue to drive forward if only to get the headline to inspire investors that all is okay. Trends of all the major indexes remain bullish, and as of now, no price action in the charts suggest that bulls are ready to stop buying. The T2122 indicator has pegged at the top of the range, indicating an extremely extended condition as we head into a big day of economic data. That said, it seems no matter how negative the financial numbers reflect on the economy and unemployment; it only inspires the bulls to buy, buy, buy.

Trade Wisely,

Doug

Comments are closed.