SPY and the QQQ provided some market lift yesterday while the DIA and IWM took a little break. Index trends remain bullish as officially kickoff the 1st quarter earnings season hearing from BLK with GS, JPM & C reports Friday morning. We will get the latest reading on Jobless Claims, Jerome Powell speaks at 12:30 AM Eastern, and President-Elect Biden will reveal his stimulus plan. These are potentially market-moving events, so stay alert for price volatility as the data is released.

Asian markets closed mixed but mostly higher as China’s December trade data beat expectations. Across the pond, European markets trade with modest gains across the board on hopes of U.S stimulus. U.S. futures trade mixed but mostly higher this morning with the intoxicating smell of freshly printed deficit spending in the air.

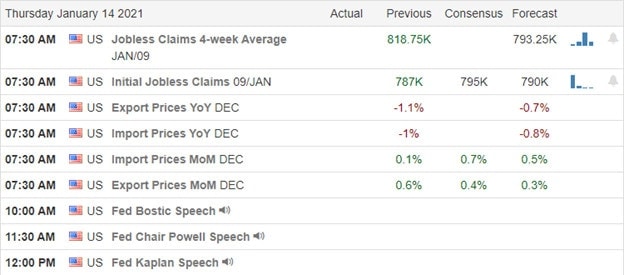

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have the 1st quarter earnings season’s official kickoff with eight verified reports. Notable reports include APHA, BLK, TSM, & DAL.

News & Technicals’

The U.S House has voted to impeach President Trump. Now the Senate will take up the issue, but according to reports, the trial may not begin until after President Biden’s inauguration. Airbnb yesterday canceled reservations in the Washington area during the inauguration. Though a bit choppy, the market managed to push upward, led by the SPY and QQQ, while the DIA and IWM chose to rest, slipping sideways. We have vaccines back in the news as J&J’s one-shot system is proving safe and generates a promising immune response. Health officials are hopeful as the new vaccine would greatly simplify the inoculation of the country. Treasury yields are again on the rise this morning with the expectation of Bidens’ stimulus plan announcement later today. The market loves freshly printed deficit spending, so be prepared for a possible reaction.

Trends remain bullish, with the indexes charts mostly consolidating as we head into the 1st quarter earnings season. Blackrock (BLK) will kick off the big bank’s reports today, followed by JPM, GS, and C on Friday. The financial sector has rallied strongly in anticipation so let’s hope it’s not a buy the rumor sell the news event. Keep in mind before the market, we get the latest reading on Jobless Claims and have Jerome Powell speaking at 12:30 PM eastern. Stay alert as big moves up or down remain quite possible.

Trade Wisley,

Doug

Comments are closed.