The energy sector was the clear winner yesterday, with the financial sector coming in a close second, helping to set new record highs Russell-2000. The Dow fell just short of setting new records as the rotation to value stocks continues. Retail had a very good day as well, surging higher as folks spend their stimulus checks. However, with high political drama in Washington, traders should prepare for the possibility of price volatility as we near the inauguration of President-elect Biden. Be prepared if a profit-taking wave begins because the point move down to price supports is substantial.

Asian markets closed mixed but mostly lower as the surge in pandemic cases puts 28 million people in lockdown. European markets trade cautiously around the flatline, while the U.S. futures seem to take a wait and see approach as the pandemic death toll sets a new daily record and the political drama in Washington unfolds. It would be wise to prepare for a bumpy ride.

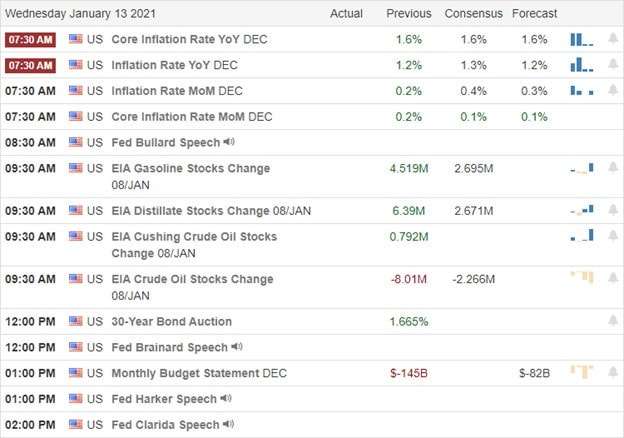

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have eight companies fessing up to quarterly results today. Notable reports include INFO, INFY, SJR, & WIT.

News & Technicals’

Another day and another record high as IWM continues to surge higher, supported by rising energy prices and strong buying in the financial sector. The bulls pushed hard but fell just short of breaking out to a new record. Unfortunately, we also set a grim new record of pandemic related death with more than 4300 Americans succumbing to the virus. China is also under pressure putting 28 million people into lockdown ahead of their lunar holiday. Facebook has again banned the President from posting to his account until after the inauguration of president-elect Biden. Though under pressure from Congress, Vise-president Pence has refused to envoke the 25th Amendment to remove President Trump from power in his last week of office. However, that is not the answer Congress wants to hear, so they are moving forward with impeachment proceedings in an attempt to remove the President from office. It will not be a surprise if the political drama in Wahington spills over to the market in the form of price volatility.

Technically there is no doubt the bulls are still in control and that the index trends remain bullish. That said, the T2122 indicator is warning once again of a short-term extended condition. The VIX also remains a bit perplexing, closing the day above a 23 handle as new record highs continue. Stay with the trend but have a plan should a profit-taking wave begin because there is a large point move before finding price supports on the charts. With many charts showing very extended conditions, it’s easy to find parabolic stocks in nearly all market sectors. Be careful not to chase!

Trade Wisely,

Doug

Comments are closed.