After a huge bullish party on the first week of 2021 where bad jobs data didn’t matter, may the futures suggest the market may have to deal with a hangover this morning. Surging pandemic numbers with California officials reporting a death every 8-minutes on average weighs on investors. Index trends remain in bullish trends and enjoy price breakout price supports just below. That said, a 200 point Dow reversal at the open with the VIX still hovering above a 20 handle could become painful if the bears begin to show their teeth.

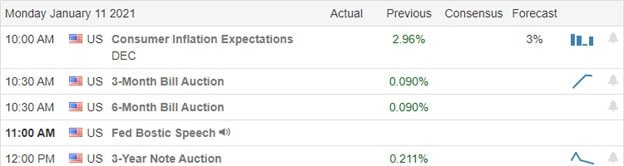

Overnight Asian markets were mixed but mostly higher. European markets currently trade in the red across the board, and U.S futures point to a gap down open ahead of a light economic calendar day. Keep in mind; we officially kick off the 1st quarter earnings season this week so expect some price volatility and wild morning swings as traders and investors react to the data.

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 11 companies that have confirmed their quarterly results will release today. Notable reports include CNXC, KRUS & SNX.

News & Technicals’

After a substantial rally on the first week of 2021, the market seems to have turned its attention to pandemic concerns. According to health officials, California is in crisis mode with hospitals over capicty and an average of one death every eight minutes. Refrigerated trucks must now be utilized as temporary storage of bodies, and waiting patients line the hallways as the system strains to provide care. Japan has now identified another variant of the virus, while countries scramble to contain two other contagious variants that have emerged in the U.K. and South Africa. The 10-year treasury is on the rose above 1.1% following Bidens Friday pledge of more economic stimulus that would be, ‘in the trillions of dollars.” If that’s not enough political news to give the market heartburn, Congress is moving forward with President Trump’s impeachment process with just a week to go before President Biden takes office.

Though it seems like there chaos around the world, the U.S. market has had an unbelievable ability to ignore continuing to set records. The jobs data seems to no longer be necessary as long as the government is willing to deficit spend. Although that would seem to have a diminishing return over time, stocks have enjoyed a ravenous bull run. Index’s remain in bullish trends as the VIX continues to hover above a 20 handle. This morning futures point to a gap down open, but with indexes above price supports and tends, it could be nothing more than a short-term pullback. Stay with the trend while keeping in mind there could be a substantial risk if the sentiment suddenly shifts. Don’t overtrade and have a plan should the bears make an appearance.

Trade Wisely,

Doug

Comments are closed.