After a hideous and disgraceful display of politically fueled violence, Congress went back to work to certify the election for our Joe Biden. Let’s hope this country can now begin to heal. The bulls are clearly in control with hopes that more government stimulus is on the way under the new administration. Futures point to a modestly bullish open ahead of our biggest day of earnings this week and an economic calendar that includes a reading on Jobless Claims.

Asian markets closed mixed but mostly higher while China telecom shares plunged after the flip-flopping NYSE delisting decision. European markets are mostly higher this morning, and the U.S. futures indicate new market records at the open. Keep in mind before the bell tomorrow; we will get the latest reading Employment situation number, so plan your risk accordingly.

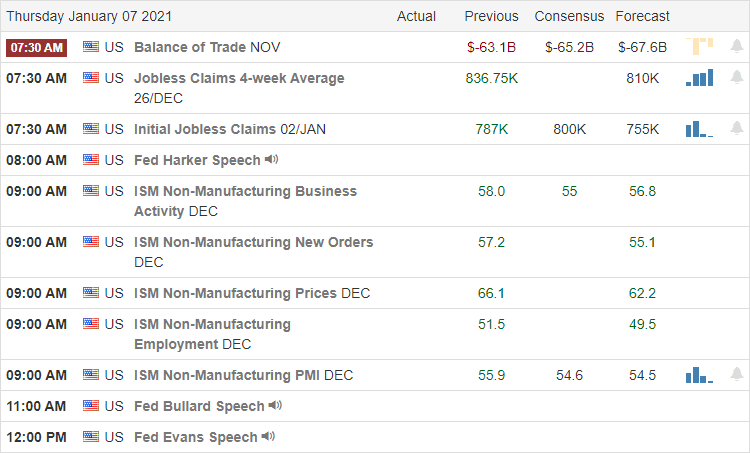

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have our most significant day with 21 confirmed reports. Before the bell, we will hear results from ANGO, AYI, BBBY, CAG, CSVI, HELE, LNN, LW, NTIC, PKE, REVG, SCHN, STZ, WBA, & WEI. After the bell, ACCD, AEHR, DCT, FC, MU, PSMT, & WDFC.

News & Technicals’

In my opinion, yesterday’s attack on the U.S., the capital, was one of the most shocking and disappointing events as our countrymen disgraced our republic. As a former military officer, I will pick up my M16 and defend the people’s right to protest. However, no matter your cause, there is no excuse for violence that puts our fellow countrymen in harm’s way. There is no excuse for this kind of behavior! After a very long night session, Congress certified the election for president-elect Joe Biden. Let’s hope the healing can now begin.

The bulls were out in force yesterday as it became evident that the Senate would flip after the runoff elections in Georgia, with the market celebrating a hopefulness of more government stimulus. The DIA and IWM closed at new record highs while the SPY pullback late in the day, losing its hold on an intraday record high. Trends remain bullish in the DIA, SPY & IWM while the QQQ displays a bit of weakness breaking its short-term uptrend. This morning, futures point to modest gains, ahead of International trade numbers and the weekly Jobless Claims report. As you plan forward, keep in mind that we will get the Employment Situation number before the bell on Friday, which is often a market mover.

Trade Wisely,

Doug

Comments are closed.