Wild Price Action

The wild price action continued yesterday with a massive whipsaw the managed to squeak out the 42nd record high for the year in the SP-500. With a massive number of earnings reports in the pipeline for the end of the week and jobs data, we should prepare for the price volatility to continue. With the blessing of the President, the CDC added two more months to the eviction moratorium even though the courts have ruled they do not wield power to do so. So hold on tight; the wild ride is likely to continue the rest of the week.

Asian markets traded mixed but mostly higher as a private survey showed growth in Chinese service activity though there is another infection concern in the Wuhan province. European indexes trade modestly higher this morning as they cautiously trade earnings results. However, with an earnings deluge and a pending ADP report, U.S. futures currently trade mixed to slightly lower. Still, the truth is anything is possible by the open, so buckle up the wild ride is about to take another lap.

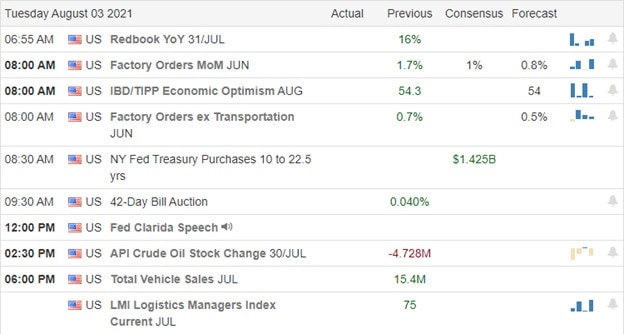

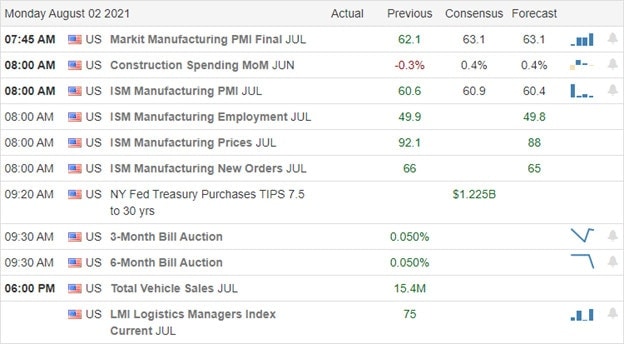

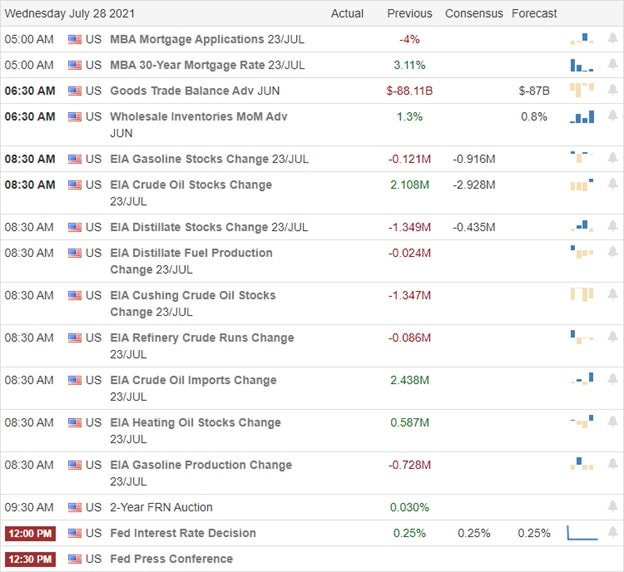

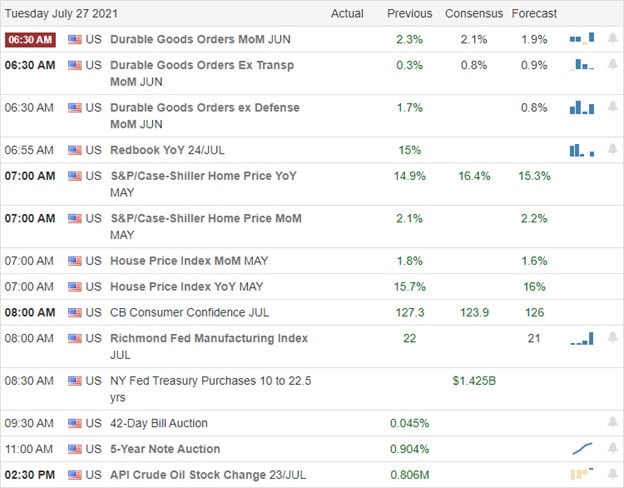

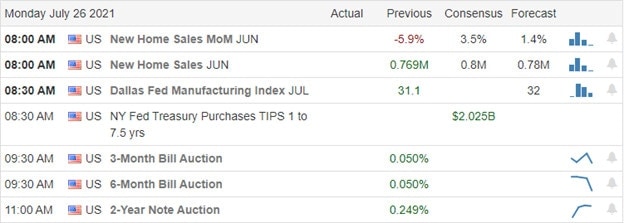

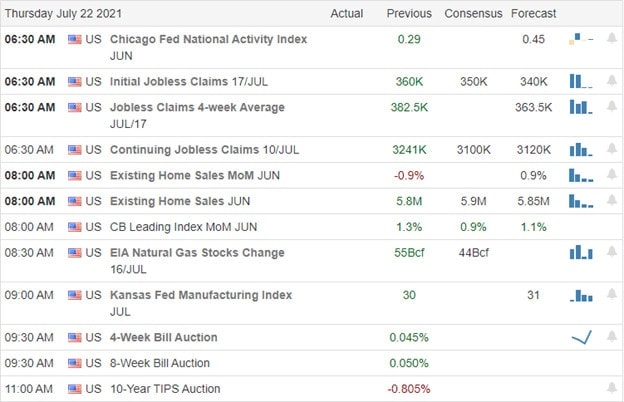

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have a big day with nearly 290 companies reporting. Notable reports include ETSY, ALB, ALL, ABC, APO, BKNG, BOOT, BWA, CVS, EA, ETR, EXC, FSLY, TWNK, HUBS, IAC, JACK, KHC, LMND, LL, MRO, MBI, MCK, MTOR, MET, MGM, NUS, PBR, DOC, QRVO, RYN, ROKU, RCL, RGR, TM, UBER, VMC, WDC, & WU.

News & Technicals’

Though the courts say the CDC does not have the authority, they went ahead with a new eviction ban with the blessing of the President through October 3rd. The President said the legal challenge would allow time to distribute funds. In other news, Biden called on Cuomo to resign after the state Attorney confirmed multiple accounts of sexual harassment. However, Cuomo refuses to resign, so it will now be up to the state assembly to impeach or remove him from office. Yellen to support the next multi-trillion-dollar spending plan, saying she believe its necessary to remain as the world’s pre-eminent economic power. Hmm, piling on more debt helps us to remain a superpower? Treasury yields rise slightly this morning, with the 10-year trading at 1.182% and the 30-year advancing to 1.854% as we wait on the private payroll number.

With a last-minute surge, the SP-500 squeaked out its 42nd new record to close another wild day of price action. After gapping up, sellers pushed the Dow down, breaking the consolidation support only to reverse in a volatile whipsaw that not only recovered the loss but tacked on another 200 points to boot. Such price volatility is excellent for intraday traders but very frustrating for swing and position traders who cannot matain an edge with huge price reversals of the last couple of days. For the rest of the week, markets will have jobs data to digest, along with a deluge of earnings reports. We begin with the ADP private payrolls number before the bell today, followed by Jobless Claims on Thursday and the Employment Situation on Friday morning. I suspect the wild price action is likely to stay with us through the rest of the week. So fasten your seatbelt tightly and plan your risk carefully.

Trade Wisely,

Doug