After setting more records in the DIA, SPY, and QQQ, the China tech crackdown is muting the wildly bullish anticipation of tech giant earnings reports after the bell today. With MSFT, AAPL, and GOOGL priced at or near all-time-highs and P/E ratios well above historical averages, there is a lot a stake. As a result, plan for a substantial gap on Wednesday morning followed by an FOMC decision. Of course, anything is possible so, prepare for a wild ride the next few days.

Asian markets traded mixed overnight, with the HIS plunging 4.22% as China puts pressure on tech stocks. European markets trade with modest declines across the board as they monitor earnings and possible infection rate impacts. Ahead of Durable Goods, Consumer Confidence, and a slew of potential market-moving earnings reports, futures are point to a mixed open but well off of overnight lows. Expect considerable price volatility as the market digests all the data.

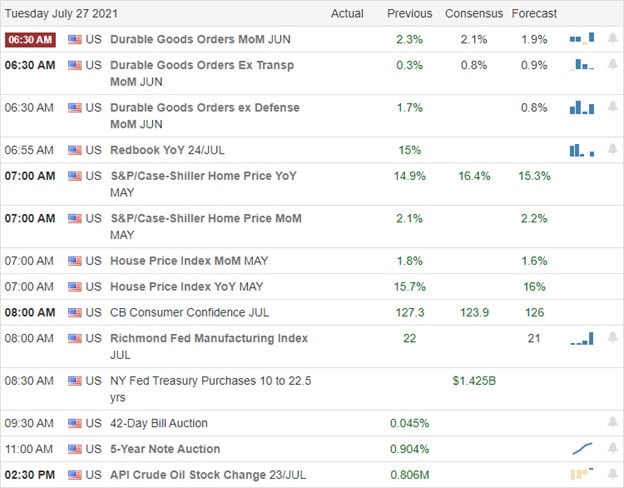

Economic Calendar

Earnings Calendar

Today is big of earnings with a significant focus on the tech giants after the bell. We have more than 100 companies listed on the calendar expected to report quarterly results. Notable reports include GOOGL, AAPL, MSFT, MMM, AMD, ADM, BSX, BYD, CHRW, CAKE, GLW, RDY, ENPH, FISV, GE, JBLU, JNPR, MAT, MDLZ, MSCI, PACR, PHM, ROK, SHW, SIRI, SWK, SBUX, UPS, V, WM, & XRX.

News & Technicals’

The China tech crackdown triggered a plunge in Hong Kong, with the HSI falling 4.22%. According to Scott Kennedy, high-level meetings between the U.S. China concluded with deteriorating relations setting unreachable demands for each other. So I guess it’s also no big surprise that China has not lived up to the phase one trade agreement with the United States. Today begins the FOMC two-day meeting with the announcement scheduled for Wednesday at 2 PM eastern followed by the chairman’s press conference at 2:30. Treasury yields are falling slightly this morning, with the 10-year dipping to 1.249% and the 30-year slipping to 1.907% ahead of auctions for 20 billion in 42-day bills and 61 billion of 5-year notes. Shipping is once again experiencing massive disruptions due to floods in China and Europe, straining global supply chains.

Though one would think all the issues listed above would slow the bull run, buyers continued to snap up stocks producing new records in the DIA, SPY, and QQQ yesterday. In addition, there is palpable anticipation for the after the bell reports from GOOGL, MSFT, and AAPL, with all of them at or near record highs. With P/E ratios already well above historical averages, the market has priced in an expectation of perfection. With these reports coming after the bell today, be prepared for a substantial market gap tomorrow morning. Your guess is as good as mine in which direction! Adding in Durable Goods and Consumer Confidence economic reports to the slew of earnings, the price action of the next couple of days are likely to challenge even the most experienced traders. Buckle up.

Trade Wisely,

Doug

Comments are closed.