Gapping up to kickoff the typically volatile August market, the nasty whipsaw that followed may have woke the mean monster of uncertainty. Of course, with the VIX rising and the Absolute Breadth Index falling with more than 700 earnings reports and lots of jobs data yet to digest, a little uncertainty is understandable. Plan your risk carefully because these big price swings can chop an account to pieces as the market searches for direction from this consolidation.

Overnight Asian markets tumbled with the Chinese government saying online gaming was opium for the mind. However, European markets sport modest gains across the board fueled by positive earnings results. With jobs data just around the corner and a slew of earnings reports rolling out U.S. futures, attempt to reverse yesterday’s selling, pointing to a substantial bullish gap-up. Hold on tight as the wild ride continues.

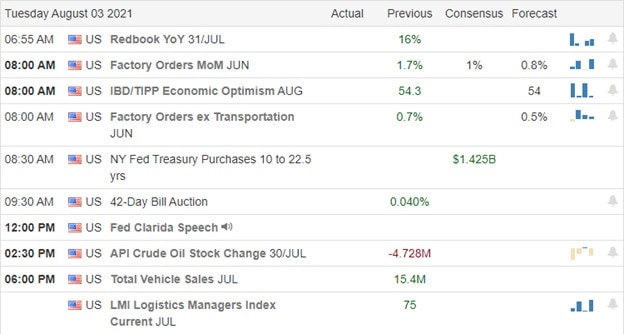

Economic Calendar

Earnings Calendar

We have a busy day on the Tuesday earnings calendar with more than 200 companies stepping up to reports quarterly results. Notable reports include ATVI, AKAM, BABA, AMGN, ARNC, CAR, BHC, APRN, BP, CLX, CZR, COP, DISCA, DD, ETN, EXPD, BEN, HSIC, HLF, HST, H, KTOS, LYV, LYFT, MAR, MTCH, MCHP, NKLA, PSX, RL, SEE, SEDG, SRC, SPWR, VVNT, WLTW, & UAA.

New & Technicals’

Western and China’s Henan province, which is significant transport hubs grapple with the aftermath of a devastating flood likely to trigger another shipping crisis. Supply chain software firm E@open said there would probably be fewer smaller discounts during the peak Black Friday sales. CNBC’s Jim Carmer says it is the height of irresponsibility to invest in Chinese stock right now and urged investors to stay away. Europe’s recovery could be derailed due to pandemic fears. According to reports, 40% of U.K. consumers are not comfortable taking vacations abroad or going to large public gathers such as sports or music events. The White House and the Congress are engaged in a game of hot potato over who’s responsible for allowing the federal eviction moratorium to expire after the CDC director could not find legal authority to extend. Let the finger-pointing and blame game begin!

Yesterday’s nasty whipsaw and rising VIX likely planted some seeds of uncertainty yesterday, but once again, the overnight session has found reason to bounce. The bearish engulfing candles left behind in the DIA, SPY, and IWM will only be valid if they follow through to the downside, and the overnight push is trying to ensure that is not going to happen. As I mentioned yesterday, August is typically volatile but toss in supply chain challenges, fears of slowing growth, and the rising infection rates and uncertainty begins to raise its ugly head. Markets hate uncertainty! With possible market-moving jobs data later this week and over 700 earnings reports to digest, expect the wild price action to continue.

Trade Wisely,

Doug

Comments are closed.