The fears that triggered Monday’s selloff appear completely forgotten as most earnings beat estimates. Traders and investors alike also seem unconcerned about the lofty valuations as indexes once again push toward record levels. So let’s keep the party going but never forget just how quickly sentiment can shift so avoid complacency and overtrading. As we approach price resistance highs in the indexes, we can’t rule out the possibility of entrenched bears that can create pop and drop patterns or even complete reversals should they see an opportunity. Plan carefully!

Asian markets rebound, led by Hong Kong surging 1.83% as China blocks pandemic origin investigations. European markets trade green across the board this morning, waiting on the ECB decision. Ahead of jobless claims, housing numbers, and a plethora of earnings data, U.S. futures point to bullish open to test price resistance levels. So hang on tight as the rollercoaster ride continues.

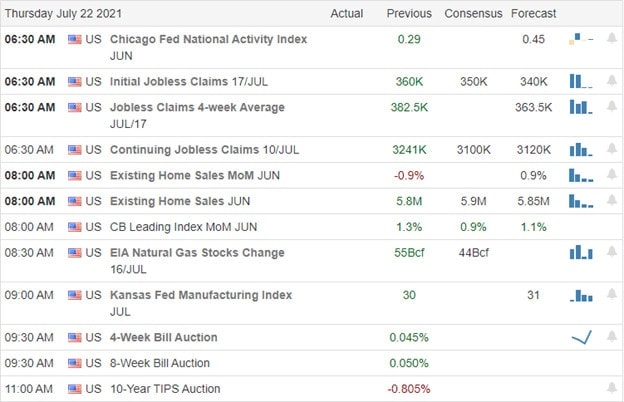

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have nearly 90 companies listed, with several unconfirmed. Notable reports include ABT, ALK, AAL, T, BIIB, BX, SAM, COF, CLF, CROX, DHI, DHR, TACO, DPZ, DOW, FITB, FCX, INTC, MMC, NEM, NUE, DGX, SNAP, SKX, LUV, TWTR, & UNP.

News & Technicals’

As infection rates rise, local officials across the U.S. are starting to reimpose masking rules. According to reports, the travel industry is looking at uncertainty with infection rates rebounding, threatening summer tourism. In a related report, China has rejected the plan to study the origin of the pandemic with mounting evidence it was a lab leak in Wuhan. Additionally, Indonesia reported the highest number of new cases globally despite emergency measures to curb the spread. Ahead of the latest reading on jobless claims, Treasury yields continue to decline this morning. The 10-year dipped to 1.275%, while the 10-year fell to 1.924%.

As most earnings beat estimates, the bulls continue surging back unconcerned about the lofty valuations. Worries that created Monday’s selloff seem totally forgotten, even as infection rates with indexes recovering. Now the question is can they push right on through the price resistance highs to set new records? The buying frenzy would suggest, yes. However, with price volatility high and prices stretched well off-price supports, the risk is high should the market suddenly care about the pandemic resurgence. Plan your risk with care, keeping in mind just how emotional the market has become. Be prepared with a plan to protect your capital should the sentiment. As we test resistance levels, take some profits or consider hedging positions if the bears happen to mount a defense. The bulls are clearly in control, but price volatility is making for a risky environment.

Trade Wisely,

Doug

Comments are closed.