With yesterday’s mild selling, there was no technical damage created by the DIA, SPY, and QQQ. However, the rising VIX, weak Absolute Market Breadth Index, and the bearish engulfing candle left behind on the QQQ may perhaps warrant a little caution should it follow through to the downside today. That said, with the estimate smashing earnings from AAPL, MSFT & GOOGL, there is no reason to believe at this point that the bulls are willing to give up this tremendous bull run. So stay focused if should the market stumble and remember that anything is possible with all the data coming our way today.

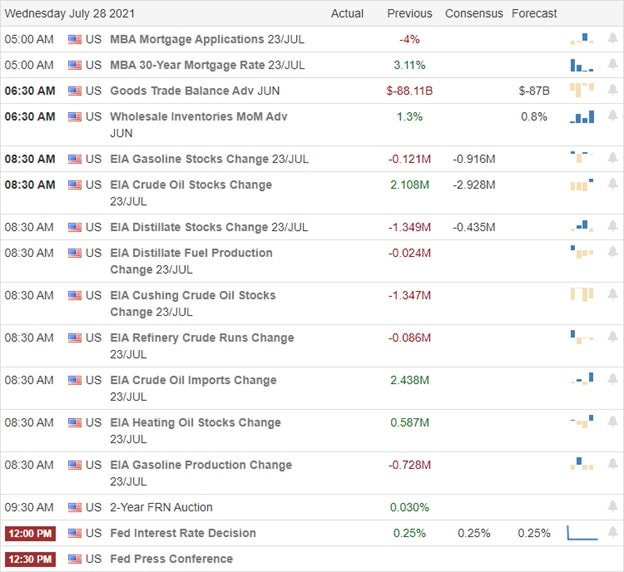

Overnight Asian markets traded mixed with Hong Kong bouncing after a nasty two-day tech selloff. European market trade cautiously higher this morning reacting to earnings and waiting on the Fed decision. With a massive number of earnings events, trade data, oil supply numbers, and the FOMC this afternoon, buckle up for another hectic day of price action.

Economic Calendar

Earnings Calendar

Another busy day on the Hump Day earnings calendar with nearly 200 companies listed, but there are several unconfirmed. Notable reports include FB, ALGN, ADP, BA, BMY, CN, CAJ, CRUS, CME, DB, F, GRNC, GD, GSK, HES, HUM, IRBT, LRCX, LPL, MCD, MTH, NSC, ORLY, OC, PYPL, PFE, PPC, QCOM, NOW, SHOP, SAVE, SPOT, TOM, VALE, WING, XLNX, XPO, YNDX, & YUMC.

News & Technicals’

AAPL, MSFT & GOOGL smashed earnings estimates after the bell yesterday, but the response in the stocks was relatively muted. So perhaps everyone is now in the wait-and-see mode for the FOMC decision and the Powell press conference later this afternoon. Treasury yields ticked a little higher this morning waiting on the FOMC, with the 10-year trading up to 1.254% and the 30-year advancing to 1.911%. According to reports, the Fed may begin talking about tightening their easy money policies and will also express concerns about the rapid spread of the delta variant. Kelvin Tay of UBS Global Wealth is warning this morning about bottom-fishing Chinese tech stocks. He says Chinese markets could see further losses from here, with funds likely swaying toward the liquidation side.

Though we saw some selling pressure yesterday, the DIA, SPY, and QQQ suffered no technical damage. However, with the QQQ leaving behind a bearish engulfing candle, it may be wise to exercise little caution should that happen to follow-through this morning. As the bulls worked to shrug off the substantial, durable goods miss, it’s interesting to note that the VIX closed the day higher. Also noteworthy is a rotation into consumer staples seems to be underway. With another massive day of earnings data and the FOMC decision this afternoon, anything is possible. So stay flexible and focused because of all this emotion and create some swift and challenging price action. That may be good for experienced day traders but can prove highly frustrating for swing traders as price wildly whips.

Trade Wisely,

Doug

Comments are closed.