After an extraordinary bullish rally that shrugged off jobs and rising infection rates, futures suggest a little profit-taking this morning. While setting new record highs, the market suffered from low volume, and VIX could not fall below support, closing above 17 handles. That said, we have a big week of tech earnings, and with the strong bullish in the sector, more records highs are certainly possible. So expect wild price volatility with large morning pops or drops because the tech giants report after the bell.

Overnight Asian markets traded mostly lower as the Chinese tech crackdown weighed on stocks. This morning, European markets trade in the red, worried about the rising infection rates amid solid earnings results. Ahead of New Home Sales and earnings, U.S. futures point to a lower open as we wait on big tech and an FOMC decision.

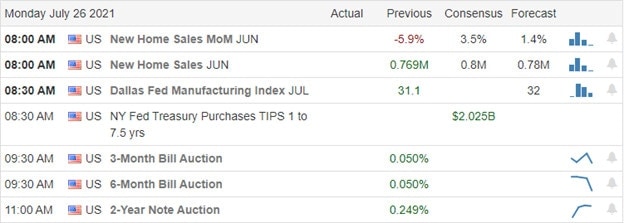

Economic Calendar

Earnings Calendar

We have more than 70 companies listed on the earnings calendar to kick off a week of big tech market-moving events. Notable reports include TSLA, AMKR, CDNS, CJKP, FFIV, HAS, LII, LMT, PKG, PETS, PCH, RRC, SBFG, & TTM.

Comments are closed.