Though we had a little pushing and shoving in the price action last week, the resting consolidation in the DIA, SPY, and QQQ was technically healthy after such a wild selloff and recovery. With three indexes within striking distance of new records, traders and investors will focus on jobs data this week, and we may experience some choppy price action as we wait. First, however, we begin the week with some key inflation data with the PMI report this morning. With about 2/3rds of the SP-500 reporting this week, there will be a lot of data for the market digest. So plan carefully and be ready for just about anything.

Asian markets began the month green across the board, with the SHANGHAI leading the way up 1.97% at the close. European markets are trade mixed with modest gains and losses this morning. As earnings roll out and facing PMI and ISM numbers, U.S. futures point to bullish open to kick off this busy week of earnings and jobs data.

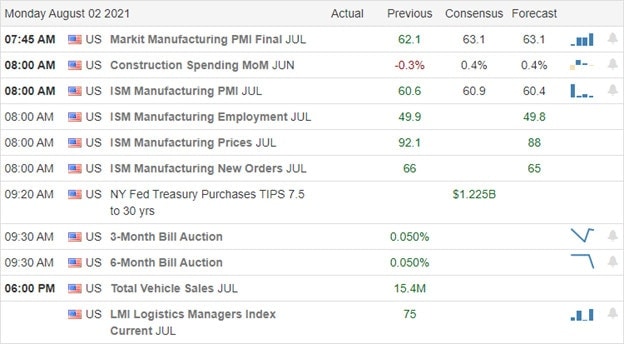

Economic Calendar

Earnings Calendar

To begin the first trading week in August, we have nearly 100 companies stepping up to report. Notable reports include ALX, ANET, CVI, FANG, EMN, RACE, GAIA, GPN, GPRE, HSBC, IPI, L, MOS, NXPI, OHI, ON, OTTR, PXD, O, SPG, TTWO. TSEM, RIG, & WMB.

News & Technicals’

Federal unemployment programs that have paid jobless benefits since March 2020 end September 6th. At this point, Congress does not appear willing to extend them again. The U. S. Senate on Sunday finalized the text for its 2700 page $1 trillion infrastructure bill. Treasury yields rise this morning ahead of PMI data, with the 10-year trading at 1.242% and the 30-year advancing to 1.916%. The reopening of hospitality services using vaccine passes has drawn criticism due to the rising infection rates. Though the steel demand is on the rise, the Chinese government is likely to lower the production in the second half of the year, dropping it below 2020 levels.

The resting consolidation over the last week in the DIA, SPY, and QQQ held above support levels, though we did have some modest pushing and shoving by the bears. As we begin the typically choppy August, all but the IWM are within striking distance of new record highs. However, the Friday Employment Situation number will be critical if the market is to continue its advance. Though the premarket activity suggests a bullish open, keep a close eye on the consolidation resistance because we may experience choppy price action as we wait on all the jobs data later this week. Stay with the bullish trend but once again avoid overtrading and remain flexible should the bears find a reason to attack.

Trade Wisely,

Doug

Comments are closed.