Significant Technical Damage

With worries, the Evergrande default contagion could spread significant technical damage to the index charts yesterday. Although the significant overnight reversal certainly relives yesterday afternoon’s short-term oversold condition, it does not relieve the extremely high price volatility danger. Consider the overhead resistance and the very real possibility of substantial intraday whipsaws. The Evergrande problem is just beginning, not over, and we have an FOMC meeting just around the corner. Emotions are high, so trade wisely.

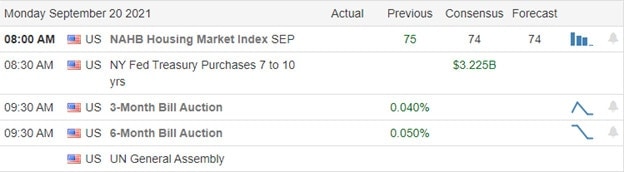

With China markets still closed for a holiday, the NIKKEI sold off 2.17%, monitoring Evergreade developments. This morning, European markets are in relief rally mode, seeing green across the board trying to overcome some of yesterday’s selloff. Ahead of Housing numbers and an FOMC meeting decision just around the corner, the U.S. futures point to a substantial gap up, this time punishing those that held short positions overnight. Stay focused as substantial intraday whipsaws are possible, making for very high-risk trading.

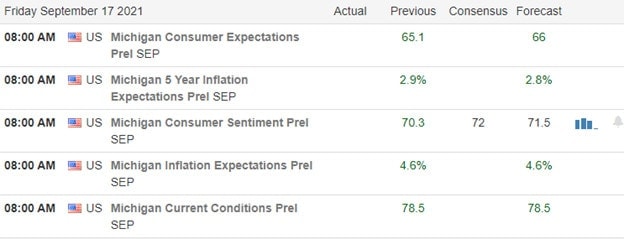

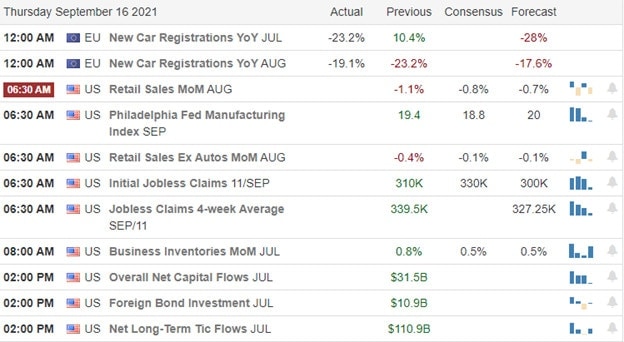

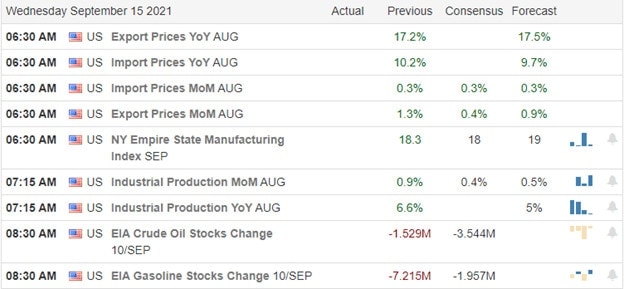

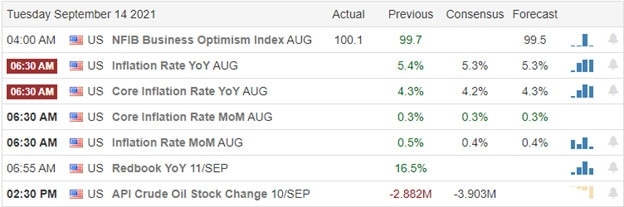

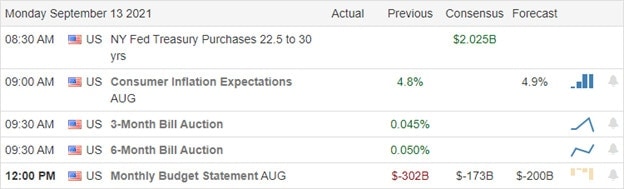

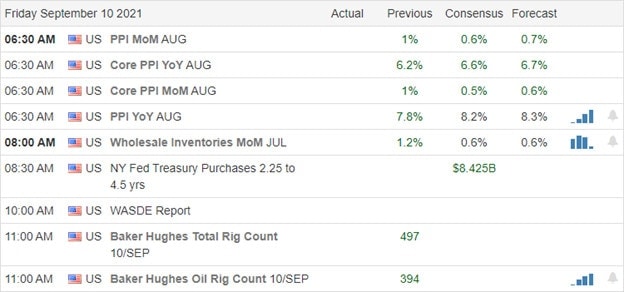

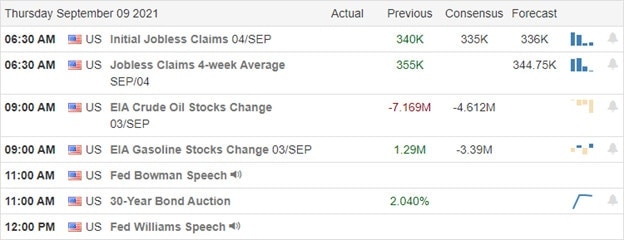

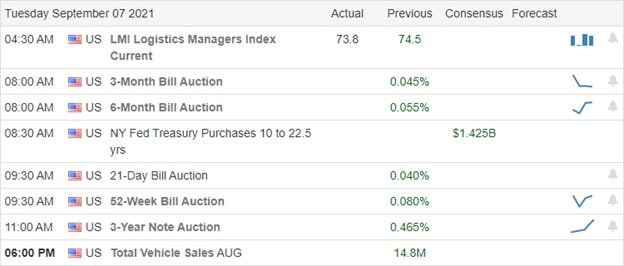

Economic Calendar

Earnings Calendar

We have just 11 companies listed on the earnings calendar, with most of several unconfirmed reports. Notable reports include FDX, ADBE, ACB, AZO, CBRL, NEOG, SFIX.

News & Technicals’

With government funding expiring at the end of September, Treasury Secretary Janet Yellen has said the U.S. would likely not be able to pay its bills sometime in October if Congress does not suspend the debt limit. As a result, Congress will attempt to include a debt ceiling suspension that will kick the can down the road funding the government through December. Economists expect Chinese officials to stem the spillover from liquidity issues at Evergrande, the country’s largest property developer, before it slams the banking system and bleeds into foreign financial centers. But strategists also say Beijing needs to act quickly to restructure Evergrande because markets are becoming nervous and hurting sentiment. Early this morning, the yield on the 10-year Treasury notes dropped 17 basis points to 1.3220%, while the 30-year fell 15 basis points to 1.8625%.

Yesterday created significant technical damage in the index charts, and likely shook investor confidence to the core. However, a substantial overnight reversal is underway to punish any short traders who chose not to take profits during yesterday’s rout. The T2122 indicator was signaling a short-term oversold condition and with a hopefulness that Beijing will step in to curb the credit crisis in the aftermath of the Evergrande default watch for a robust short-squeeze relief rally. That said, be very careful as we approach resistance levels and watch for possible whipsaws because the bear may not give up so easily this time around. The big emotional gap up this morning makes for high-risk long entries, especially when you consider the very high implied volatility and FOMC decision just around the corner. I suspect the rollercoaster ride is not over, considering the considerable decline in bond yields this morning.

Trade Wisely,

Doug