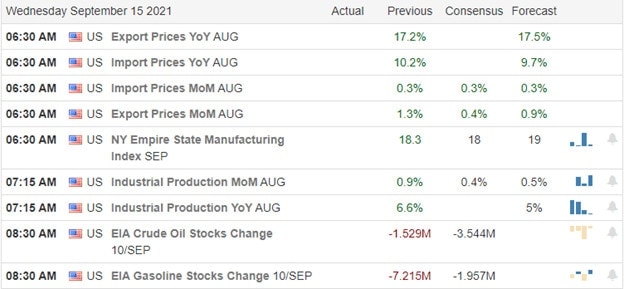

A reduction of one-tenth of one percent was not enough to convince the bears to go back to sleep as the CPI reported a 5.3% rate of inflation. The DIA and IWM failed their 50-day averages, and the SPY closed the day, hovering less than half of one percent above its 50-day. With the Industrial Production expected to decline today, could it continue to inspire the bears? Maybe but I suspect a choppy day of price action as we wait for the Jobless Claims and Retail Sales numbers coming before the open Thursday.

Overnight Asian markets tumbled after China’s retail sales data came in at 2.5% rather than the expected 7% growth estimate. European markets trade mixed but mostly lower this morning in reaction to the China data and U.S. inflation. However, once again, here in the U.S., futures currently point to a bullish open. So will it be another pop and drop, or will the bulls dig in and defend a day before our reading on Retail Sales?

Economic Calendar

Earnings Calendar

We have a very light day on the earnings calendar with just eight companies listed. Notable reports include JKS and WEBR.

News & Technicals’

According to a projection by NBC news, Governor Newsom survived the recall vote and will retain his office. Apple shares slid lower yesterday during its announcement of new product upgrades though the company expects a super cycle of device upgrades by consumers. North Korea launched another ballistic missile off its east coast as the Chinese Foreign Minister visited Seoul. Japanese Prime Minister said the missile launch is simply outrageous and is a threat to the peace and security of the region. SEC Chair Gary Gensler said they are working overtime to create a set of rules to oversee the volatile cryptocurrency markets. U.S. treasuries trade mixed Wednesday morning, with the 10-year rising to 1.28% and the 30-year declining to 1.845%.

Though the CPI said that inflation had moderated by one-tenth of a percent in August, the bears engaged after gapping up at the open. The DIA suffered the worst of the technical damage failing at its 50-day average and confirming a lower low. The worries of inflation also pushed the IWM back below its 50-day, missing its 200-day by less than half of one percent. The SPY closed the day within striking distance of its 50-day average should the bears find some additional energy today. Amazingly big tech held up very well amidst the selling, and the VIX indicated no elevation in fear. Watch the Industrial Production at 9:15 AM eastern is expected to decline slightly, but if it were to miss the estimate, it could serve as another stumbling block today. As you plan forward, remember we have Retail Sales numbers on Thursday along with Jobless Claims before the open, adding to the newsy intrigue of this week.

Trade Wisely,

Doug

Comments are closed.