Friday’s morning gap set a bull trap that likely shook investor confidence as Produce Prices inked a new recorded high. Something to consider this morning with the futures pushing for a significant gap up open this morning ahead of the Tuesday CPI number. The VIX closed above a 20-handle on Friday; prepare for some wild price action to begin the week that could include some nasty big point whipsaws or full-on reversals as we wrangle with higher inflation, a slowing economy, a debt ceiling, and the possibility of taper on the horizon.

Overnight Asian traded in a choppy session as EV stocks now come under Chinese regulatory scrutiny. However, European markets are decidedly bullish, trying to shake off inflation concerns. U.S. futures point to a substantial bullish gap trying to put on a brave face with CPI, Retail Sale, and Consumer Sentiment heading our way later this week. With the VIX elevated, prepare for just about anything as we bounce toward overhead resistance levels.

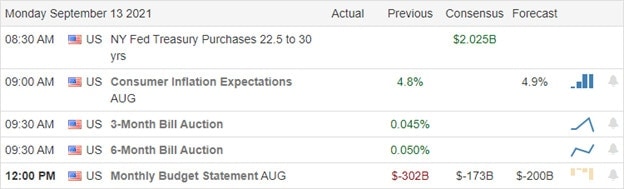

Economic Calendar

Earnings Calendar

We kick off the trading week with 25 companies listed on the earnings calendar, with a significant number of them unconfirmed. The notable report is ORCL after the bell today.

News & Technicals’

The markets had a rough end to last week after Produce Prices came showing wholesale prices up 8.3%, the highest level ever recorded. Then, on Tuesday, we will get another reading on inflation with Consumer Price Index that may be critical to the Fed’s decision on tapering. Finally, on Thursday, it will be Retail Sales figures and Jobless Claims with another reading on Consumer Sentiment, Friday, which currently sets at a 2011 low. Tuesday will also bring the hotly contested recall election to a vote. With the debt ceiling looming, Senator Manchin said he would not vote for the $3.5 trillion budget bill adding that there’s no way to meet the September 27th deadline. With that in mind, it seems somewhat odd that the Treasury yields are trading lower this morning. This morning the 10-year dipped to 1.336%, and the 30-year fell to 1.922%, with the deadline looming.

Friday morning futures set a bull trap gapping higher at the open but quickly reversing and likely shaking investor confidence. The DIA suffered the worst technical damage, closing well below its 50-day average, creating a lower and entering a downtrend technically. However, the SPY and QQQ defiantly held onto the current uptrend even as the Friday selling spilled over into the tech giants. U.S. futures are in bounce mode this morning but be very careful rushing in trades. Buying this dip could be very dangerous should the CPI come in hotter than expected on Tuesday. As we gap up toward price resistance levels, we can’t rule out another bull trap or wild whipsaw. With the VIX above a 20 handle, be prepared for some challenging volatility to begin the week.

Trade Wisely,

Doug

Comments are closed.