The market chose to ignore the disappointing jobs numbers and the unemployment benefits cliff as we slid into the holiday weekend with the assumption this will allow the Fed to continue printing. As a result, the index trends remain very bullish, with the DIA, SPY, and QQQ consolidating within striking distance of new record highs. With a light week of economic and earnings data, the market may become more sensitive to geopolitical news, or we may see a light and choppy week of price action.

Overnight Asian markets mostly rallied as Chain’s exports topped expectations. However, European markets trade modestly bearish this morning, concerned about the declining jobs and consumer activity. Here in the U.S., futures point to a flat mixed open that could prove to be a light volume day as traders extend their holiday with a bit of vacation time.

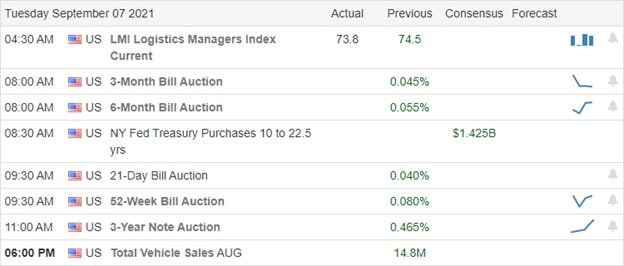

Economic Calendar

Earnings Calendar

We have a light day on the Tuesday earnings calendar with 18 companies listed and several unconfirmed reports. Notable reports include AMBA, AMWD, CHS, CRWD, DBI, NTES, & PVA.

News & Technicals’

Though a little surprising, the market chose to ignore the massive miss of the employment situation, likely due to the hope that the Fed will keep printing 120 billion a month rather than tapering. As a result, Goldman has cut its GDP forecast for the second time in the last 30 days, citing pandemic impacts and the fading of fiscal stimulus. Moreover, yesterday was the end of the unemployment bonuses, and apparently, millions have exhausted their unemployment benefits in total, raising concerns with the declining consumer sentiment and confidence. However, the U.S. Treasury yields seem to have shrugged off the disappointing jobs data, with the 10-year rising to 1.353% and the 30-year trading up to 1.97%.

Technically speaking, the price action of the index charts appears to have no concern at all about the unemployment benefits cliff or the lackluster jobs numbers. On the contrary, the DIA, SPY, and QQQ remain bullish, all within striking distance of new record highs. Over the last two weeks, the IWM has improved dramatically yet still has significant overhead resistance to overcome. With a holiday-shortened trading week, light earnings calendar, and an economic calendar with no significant market-moving reports, it may be difficult for the bulls and bears to find inspiration. In addition, please keep in mind volume could be noticeably light today as many traders may have extended their long weekend with additional vacation time. As I keep repeating, stay with the trend but guard against complacency if the market suddenly decides to care about the weakening economic data.

Trade Wisely,

Doug

Comments are closed.