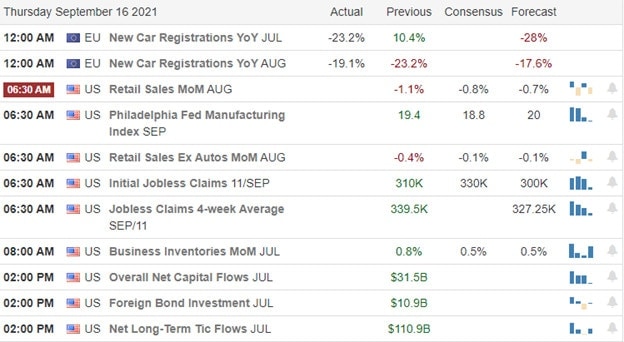

This morning’s question is whether the Jobless Claims and Retail Sales numbers support yesterday’s relief rally or if the bears find another reason to attack? The DIA and IWM are both in a precarious situation concerning their 50-day averages. On the other hand, the SPY and QQQ successfully held bullish trends with yesterday’s bounce. So get ready for some price action volatility as the market reacts to this data. We could easily experience a short squeeze if the data is good or see the index charts suffer substantial technical damage if the market reacts negatively. Trade wisely!

Asian markets closed mostly lower overnight with worries of an Evergrande default and casinos stocks continuing to tumble due to possible Chinese regulation changes. However, European markets see green across the board this morning with modest gains. Ahead of potentially market-moving data, U.S. futures trade slightly in the red at the time of this report, but anything is possible by the open.

Economic Calendar

Earnings Calendar

Although we have 16 companies listed on the earnings calendar, only one confirmed report from FANDY is not noteworthy. The market will have to elsewhere to find inspiration.

News & Techincals’

The housing authority has notified China’s major banks that Evergrande Group won’t be able to pay loan interest due Sept. 20. In addition, regulators have warned of broader risks to the country’s financial system if the company’s $305 billion of liabilities can not be contained. Rising energy prices as we head into the winter are becoming a major concern in Europe and making the market nervous. What’s more, the run in energy prices is not expected to end anytime soon due to low wind output and the rising commodity prices for carbon. Who could have guessed that massive amounts of money printing would have a negative effect on energy prices? Hmmm! Treasury yields moved slightly higher this morning, with the 10-year trading up to 1.306% and the 30-year advancing to 1.871% ahead of jobs of and retail data.

The technicals remain precarious for the DIA and IWM as all eyes turn to Jobless Claims and Retail Sales data before the market opens. Should the bears find a reason to attack, it could create significant technical damage in the index charts and seriously shake investor confidence after yesterday’s hopeful relief rally. On the other hand, if the bulls can find inspiration, yesterday’s bounce off the bullish trend in the SPY and QQQ could spark a substantial short squeeze. One can only guess what the reaction might be, so get ready for a potentially wild price action open where anything is possible. Remember that the reaction in the premarket futures has quickly reversed at the open in the last few trading days. So take a breath and watch price action before leaping in, and even then, prepare for whipsaws or even complete reversals.

Trade Wisely,

Doug

Comments are closed.