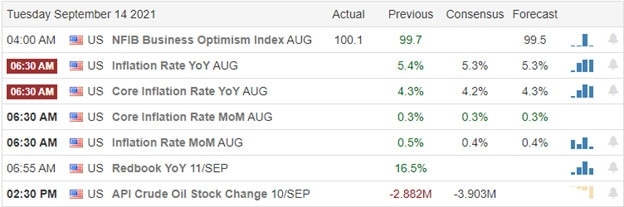

Yesterday’s big gap up quickly lost energy as the market spent the day gyrating with intraday whipsaws waiting on the CPI number coming out before the bell this morning. Economists expect inflation to remain hot, with a year-over-year increase of 5.4% in August. However, with GDP revised lower, increasing inflation, and newly proposed tax increases, uncertainty is growing, so plan your risk carefully. Later this week, other possible stumbling blocks include Retail Sales and Consumer Sentiment, so stay frosty, my friends.

During the night, Asian markets traded mixed as Evergrande warned of a possible default on its massive debt due to property sales declining. European markets trade mixed but relatively flat with eyes on the pending read of inflation in the U.S. However, the premarket pump shows modest gains across the board in the U.S. futures as we wait for the CPI number. So buckle up; it could be a wild ride as the market digests the impacts of inflation.

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have just 14 companies listed, with several that are unconfirmed. Notable reports include ASPU, IBEX, and SKIL.

News & Technicals’

It seems the entire world is waiting and watching to see what happens when the CPI number comes out at 8:30 AM Eastern. According to reports, economists expect inflation to continue running hot at a pace of 5.4% increase year over year in August. At the same time, the congressional democrats propose new taxes as they attempt to raise the corporate tax rates to 26.5% and individual top tax rates to 39.6%. In addition, the proposal includes a surcharge on individual incomes above $5 million and a capital gains tax of 25%. Treasury yields are rising this morning, with the 10-year trading up to 1.341% and the 30-year increasing to 1.917% in anticipation of the CPI reading. We also have the Apple overly dramatic reveal of its newly upgraded products, but there is a concern about production delays due to chip shortages.

On the technical front, not much changed yesterday as the markets whipsawed due to intraday volatility. The DIA remained below its 50-day average even after snapping a 5-day selling streak while the SPY and QQQ cling to bullish trends, mainly with the buying support of big tech. With the Atlanta Fed downgrading the GDP estimate by 41% to 3.7%, the worry about a slowing economy amid rising inflation and proposed tax increases the uncertainty about the path forward. How the market reacts to the CPI number this morning is anyone’s guess, so remain focused and flexible. Also, remember we have still have the nail-biter reports of Retail Sales and Consumer Sentiment later this week, keeping traders and investors on the edge of their seats.

Trade Wisely,

Doug

Comments are closed.