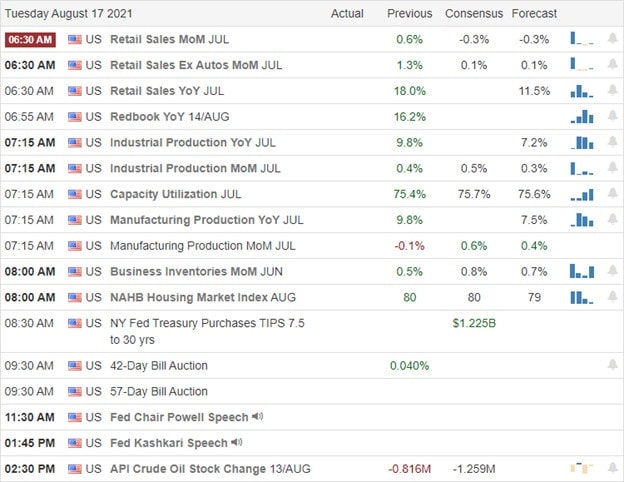

The early selloff triggered a massive intraday whipsaw that set new records in the DIA and SPY as buy the dip buyers rushed back in with a fear of missing out. Unfortunately, this morning, many may feel pain with an overnight gap down, threatening to take all or yesterday’s gains back in one fell swoop. Keep your fingers crossed that the Retail Sale numbers come in better than expected, or this could prove to be a rough day.

The seeing began overnight as Asian markets sold off across the board on fears of more Chinese internet regulations. European markets trade primarily lower this morning, keeping an eye on the economic data and the Afghanistan crisis. In addition, as earnings roll out U.S. futures, currently suggest an overnight reversal gap down ahead of a vital retail sales number that could improve or worsen the market open. So, tighten your seatbelt and get ready for a bumpy ride!

Economic Calendar

Earnings Calendar

The number of earnings events drop off today with just 37 companies listed, and nearly half are unconfirmed. Notable reports include HD, WMT, A, AMCR, CRMT, CREE, DNUT, LZB, PANDY, QUIK, & SE.

News & Technicals’

Home Depot shares decline this morning after a sold beat on estimates after the company reported that the do-it-yourself trends have weakened. The U.S. sets new records as pandemic infections rise, but less than 11% of hospital beds are used nationwide. Oregon has 56.8% of its residents fully vaccinated but has seen an increase of 11.4% in infections. Hawaii is 54.3% vaccinated with infections up 12.3%, Florida 50.3% vs. 28.2 and Missippi 35.8% vs. 18.7% increase. Flights have resumed from the Kabul Airport as people scramble to leave Afghanistan, with the U.K. foreign secretary see’s the situation stabilizing. Treasury yields moved slightly lower this morning, with the 10-year trading at 1.23% and the 30-year falling to 1.898%.

So what is a trader to do with a market producing a massive intraday whipsaw that set new record highs with traders rushing in near the close? Well, if you’re anything like me, you either stand aside, seeing no edge as a swing trader or chose to do a little day trading to take advantage of the wild price volatility. Traders that bought up stocks yesterday could experience a little pain this morning with an overnight whipsaw down. The selling began overnight as with China internet shares falling as regulatory fears rise. Traders now face a retail sales number before the open that consensus suggests may decline, and that sentiment seems to have been confirmed in the Home Depot guiding sales lower in their earnings report. I said yesterday to prepare for price volatility, but holy cow, this is ridiculous! Unless you’re an experienced day-trader, you may find it nearly impossible to matain a trading edge. The song’s lyrics, The Gambler says it best, Know when to hold em’, know when to fold em,’ know when to walk away, and know when to run! So buckle up it could be another wild ride today.

Trade Wisely,

Doug

Comments are closed.