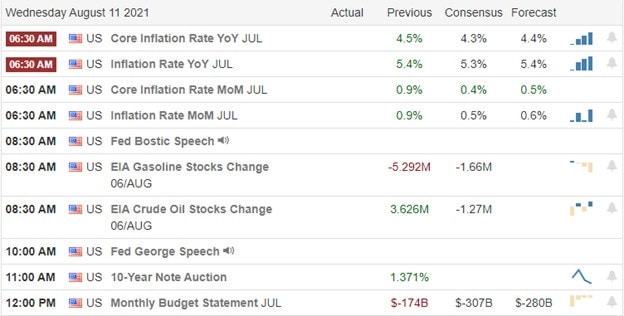

Focus this morning will turn to the consumer inflation numbers that economists expect to come once again come in hot. However, the hope is prices have peaked, and the increases will be temporary, as the Fed has suggested. I must admit to skepticism on that point, but time will tell. As earnings continue to roll out positively, the DIA and SPY printed more new records while, at the same time, the absolute breadth index fell near a 2-year low. The 10-year Treasury yields rose three basis points, and the 30-year rallied close to 3 basis points in year morning trading ahead of the CPI report.

Asian markets ended the day with modest gains after a choppy session of trading. European markets trade green across the board this morning, but gains are modest ahead of the U.S. opening bell. With a substantial consumer inflation number pending, the U.S. futures suggest a flat mixed open, but that is likely to change dramatically market reacts to the CPI number before the bell. So expect an extra dose of price volatility at the open as traders and investors digest the results.

Economic Calendar

Earnings Calendar

We have 140 companies listed on the Wednesday earnings calendar, with quite a few that are unconfirmed. Notable reports include AIT, ARRY, BLNK, BMBL, CLOV, EBAY, XONE, FOSL, RIDE, MNKD, NGMS, NIO, PRGO, RXT, RGLD, RPRX, STAF, VRM, & WEN.

News and Technicals’

After passing a 1.2 trillion dollar plan on infrastructure, the Senate passed the framework for another 3.5 trillion spending plan before leaving on summer break. However, both plans could take weeks, if not months, to make their way through the house. Then, in what is likely the largest cryptocurrency thefts to date, more than $600 million was stolen by hackers. According to reports, Poly Network disclosed the attack on Twitter, asking them to return the hacked assets. Yeah, that should work, LOL. Poly Network is a platform that looks to connect different blockchains so that they work together. Finally, as gas prices rise, the White House will call on OPEC to raise its oil production. The national average is up about a dollar per gallon on Tuesday at $3.18.

Today the market will turn its focus to consumer inflation with the latest CPI reading before the bell. Economists expect the number to come in hot, climbing 0.5% for the month and 5.3% yearly. Although they expect the prices to have peaked, the big question is whether it’s elevated temporarily as the Fed has suggested. Unfortunately, economists expect to see continued increases. While setting new records in the DIA and SPY yesterday, the absolute breadth index registered its lowest low in nearly 2-years. That said, the index trends remain strongly bullish, with futures mixed as we wait on the CPI number.

Trade Wisely,

Doug

Comments are closed.