Credit Rating Cuts?

Despite the better-than-expected retail sales figures the Tuesday market reacted negatively to the slowing China economy and the possible bank ratings cuts that Fitch warned could be on the way. The VIX made its first higher low in months as sentiment shifted as the SPY, QQQ & IWM dipped below their 50-day moving average at the close. Today we will continue with the big box retailers with TGT kicking off the notable reports this morning along with Housing, Industrial Production, Oil Status, and the FOMC minutes to inspire. Expect price volatility watching for the possibility of a relief rally that begins at any time if the data can allow the bears to relax.

Overnight Asian markets closed red across the board reacting to the warning of U.S. banks facing possible credit downgrades from Fitch. However, European markets trade mixed as the U.K. continues to deal with inflation with house prices rising 1.7%. Ahead of earnings and economic data U.S. futures point flat open as the recent confidence fades to uncertainty.

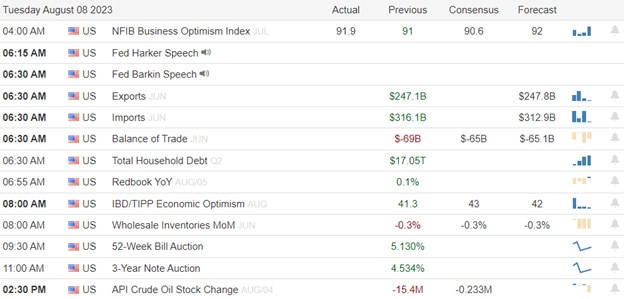

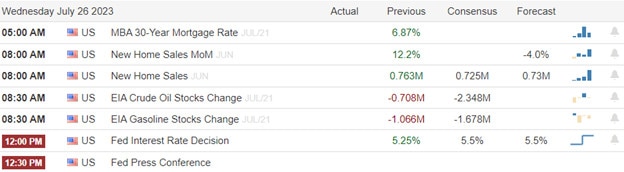

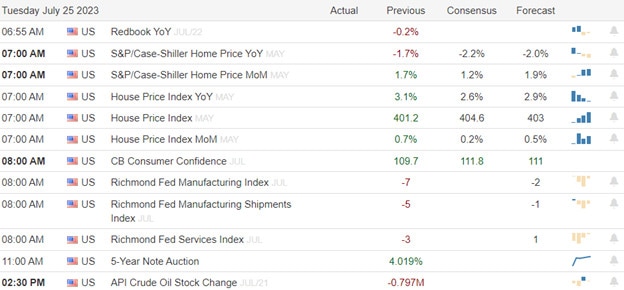

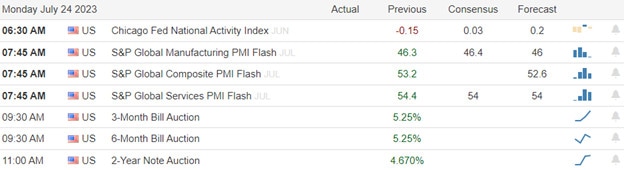

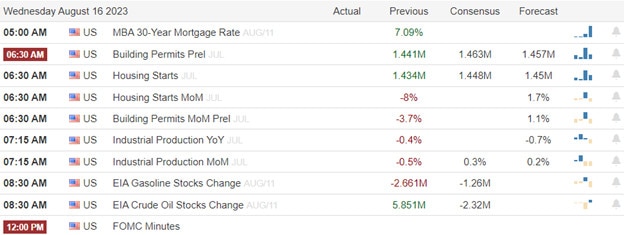

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ZIM, JD, TGT, TJX, STNE, and CSCO.

News & Technicals’

Tencent, one of the largest technology companies in China, announced its second-quarter earnings on Wednesday, revealing a strong increase in profit but a disappointing revenue growth. The company said that its net profit rose by 29% year-on-year to 42.6 billion yuan ($6.6 billion), beating analysts’ estimates. However, its revenue only grew by 20% to 138.3 billion yuan ($21.4 billion), missing the market expectations of 143.4 billion yuan ($22.2 billion). The mixed results reflect the impact of Tencent’s cost-cutting measures and the challenging economic environment in China amid the pandemic recovery.

Intel, the world’s largest chipmaker, announced on Wednesday that it has called off its deal to acquire Tower Semiconductor, an Israeli company that specializes in contract chip manufacturing. The reason for the termination was the failure to obtain the necessary regulatory approval from various authorities. Intel will pay a break-up fee of $353 million to Tower, as per the terms of the agreement. The deal, which was valued at $5.4 billion, was announced in February 2022 and aimed to boost Intel’s production capacity and diversify its product portfolio. However, the deal faced scrutiny from regulators amid the global chip shortage and geopolitical tensions.

Disney, the entertainment giant, is facing a lawsuit from TSG Entertainment, a film financing company that has backed many of its 20th Century Fox movies. The suit, filed on Tuesday in Los Angeles Superior Court, claims that Disney breached its contract with TSG by withholding profits from the films and diverting them to its streaming platforms, such as Disney+ and Hulu. The suit also accuses Disney of manipulating its accounting and reporting practices to inflate its stock price and reduce its obligations to TSG. TSG alleges that Disney’s actions have harmed its ability to invest in new films and to sell its stakes in existing films, causing it significant losses.

The stock market ended the day with losses on Tuesday, as investors were worried by weak economic data from China and the possibility of U.S. banks facing credit rating cuts by Fitch. These negative factors outweighed the positive news of higher U.S. retail sales and pushed the stocks further down in August. The 10-year Treasury yield also rose again, reaching 4.2%, the highest level in 2023 and close to the peak seen last fall. Oil prices also fell by more than 1.5% due to concerns over China’s economic slowdown. The T2122 indicator fell into the short-term oversold area as the VIX made its first higher low in months raising some concerns. The bull or bears will be looking for inspiration today in Mortgage Apps, Housing Starts, Industrial Production, Petroleum Status, and FOMC minutes. Of course, we also have several notable earnings with the theme of big box retailer Target kicking it off this morning.

Trade Wisely,

Doug