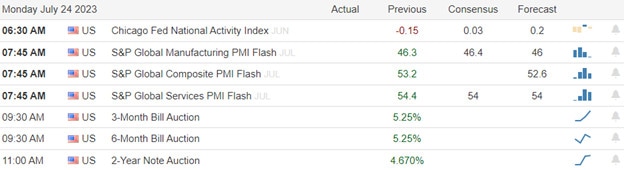

Indexes had a mixed performance on Friday with the DIA stretching into a 10-day rally while the SPY, QQQ, and IWM pulled back in a low-volume rest from their short-term overbought condition. However, this week expects high emotions with a week of market-moving events such as an FOMC decision, tech giant earnings, along several key economic reports. That said, today could be a hurry-up-and-wait anticipation day with a PMI report with a few notable earnings reports to inspire the bulls or bears.

Asian markets traded mixed with the NIKKEI leading the bulls up 1.27% and Hong Kong favoring the bears down 2.13%. European markets trade mixed and muted with a pending ECB rate decision on the horizon. U.S. futures continue to show incredible confidence pointing to a bullish open ahead of the big week of data making anything possible with gaps, reversals, and wild price volatility as the market reacts. Tighten up your seatbelt it’s likely going to be a wild ride!

Economic Calendar

Earnings Calendar

Notable reports for Monday include AGNC, ARE, BRO, CDNS, CLF, DPZ, FFIV, LOGI, MEDP, NXGN, NXPI, PKG, RRC, SSD, and WHR.

News & Technicals’

The U.S. housing market has been on a strong upward trend for the past 10 years, but that could change soon as the Fed tightens its monetary policy. According to Yale economist Robert Shiller, who co-created the S&P Case-Shiller U.S. National Home Price Index, the anticipation of higher interest rates has fueled the demand for homes among both existing and potential buyers. However, once the Fed stops raising rates, the price growth could slow down or even reverse, Shiller warned.

Oil prices are set to surge in the coming months as the global demand for crude oil outstrips the supply, according to Goldman Sachs. The bank expects the oil market to face a “sizeable deficit” of 2.5 million barrels per day in the fourth quarter of 2023, driven by strong economic recovery, low inventories, and limited spare capacity. As a result, Goldman Sachs predicts that Brent crude, the international benchmark for oil prices, will climb from its current level of around $80 per barrel to $86 per barrel by the end of the year, reaching an “all-time high” in real terms.

JP Morgan has turned bearish on Country Garden and Country Garden Services, two of China’s largest property developers, amid the ongoing turmoil in the real estate sector. The bank lowered its ratings for both companies from neutral to underweight, citing concerns over their liquidity, profitability, and growth prospects. JP Morgan also slashed its target prices for Country Garden and Country Garden Services by more than 50%, from HK$8.5 to HK$4 and from HK$40 to HK$18, respectively.

The U.S. stock market showed a mixed performance Friday, with the S&P 500 rising and the Nasdaq falling, as technology shares continued to lose momentum after disappointing earnings results. The Dow, however, extended its winning streak to 10 days, the longest in four years. This week will bring a flurry of important data and events, including the second-quarter GDP report, the PCE inflation measure, the Fed’s policy decision, and the earnings reports of some of the biggest tech companies. I would expect considerable price volatility with whipsaws and overnight reversals as markets react to all the data. Plan your risk carefully!

Trade Wisely,

Doug

Comments are closed.