Monday’s price action relieved some of last week’s selling pressure as markets bounced back with the Dow leading the buying while the other indexes suffered from low volume. However, bad economic data from China overnight could reverse a significant portion of yesterday’s gains at the open. Investors will also have a slew of earnings reports and International Trade numbers to find inspiration as the looming inflation data looms on the horizon. With stocks priced near and even above perfection expect considerable volatility as weakening economic conditions bring a rise to a rapidly restricting liquidity condition.

Asian markets traded mixed overnight as China’s trade numbers fall more than expected as their economy continues to struggle with contraction. European markets trade bearishly this morning with worries of pending inflation data and sinking Italian banks. U.S. futures are under pressure this morning with banks seeing weakness, and bad Chinese trade data suggesting a gap down open ahead of earnings results.

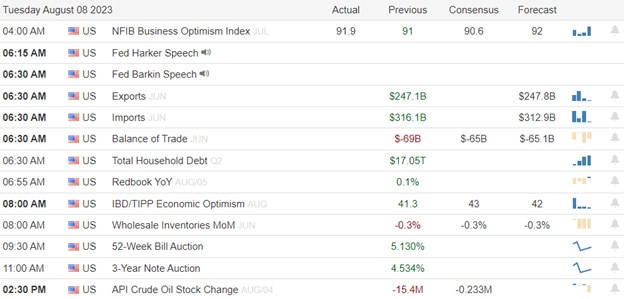

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include ADT, AKAM, BIRD, AMG, ANGI, ARMK, ARRY, TECH, BLNK, BMBL, CPRI, CELH, CHH, CMP, CPNG, DAR, DDOG, APPS, DUK, DUOL, BROS, LLY, ENR, EXPD, FLT, FOXA, GFS, HL, HNST, TWNK, IAC, NVTA, IRBT, J, KLIC, LI, LYFT, MTTR, MPW, NYT, NVAX, OGN, PAYO, PRGO, PTRA, PUBM, QSR, RIVN, SEE, SEAS, SMCI, TTWO, TWLO, UAA, UPS, WMG, WE, & ZTS.

News & Technicals’

United Parcel Service (UPS), the world’s largest package delivery company, has revised its revenue outlook for 2023, citing slower growth in e-commerce demand and a more generous labor contract for its workers. The company now expects to generate about $93 billion in consolidated revenue in 2023, down from its previous estimate of about $97 billion. The lower forecast reflects the challenges that UPS faces in maintaining its profitability and market share in the highly competitive and dynamic e-commerce sector.

Lucid Motors, a leading electric vehicle maker, reported disappointing financial results for the second quarter of 2023, missing both revenue and delivery targets. The company generated only $150 million in revenue, below the average analyst estimate of $170 million. It also delivered only 1,200 units of its flagship Air electric luxury sedan, falling short of the expected 1,500 units. The company blamed the lower-than-expected performance on supply chain disruptions and production challenges amid the global chip shortage and the COVID-19 pandemic. However, the company also announced that it had raised $3 billion in a private placement in May, which extended its cash runway by about a year, until 2025. The capital raise was seen as a positive sign by some investors, who believe that Lucid has strong growth potential and a competitive edge in the electric vehicle market.

China’s trade activity slowed down sharply in July, indicating a weakening of both domestic and global demand amid the ongoing COVID-19 pandemic and geopolitical tensions. The country’s exports fell by 8.1% year-on-year in July, while imports dropped by 11.2%. Both figures were worse than the market expectations of a 3.5% decline in exports and a 6.8% decrease in imports. The trade surplus also narrowed to $42.8 billion from $51.5 billion in June. The data showed that China’s trade with its major partners, such as the US, the EU, Japan, and ASEAN, all contracted in July. Among the few higher-value export categories that saw a significant increase in the first seven months of the year were cars and suitcases, which rose by 28.9% and 25.6% respectively. However, these gains were offset by the sharp declines in other sectors, such as textiles, garments, footwear, and furniture. The trade data suggested that China’s economic recovery from the pandemic was losing momentum and that the country faced increasing challenges from both external and internal factors.

Markets bounced back on Monday with the Dow leading the way although the SPY, QQQ & IWM delivered a lackluster performance on a choppy low volume day. Investors appear to be giving a nod to the uncertainty ahead in the U.S. inflation data that will be released on Thursday morning. Bond yields also edged up slightly, with the 10-year U.S. yield rising by about 0.03% to 4.09%, as the VIX pulled back relaxing some of last week’s market fears. Today investors face a big day of earnings as well as the International Trade numbers coming in before the bell.

Trade Wisely,

Doug

Comments are closed.