Tuesday started the day slightly negative but the bulls quickly surged higher on massive enthusiasm as better-than-expected earnings triggered a fear of missing out rally pushing indexed into an extremely overbought condition. AI announcements kept the bullish energy going right into the close of the day. Today we ramp up the number of earnings events that could keep the party going but traders chasing already-extended stocks is risky because a pullback wave could begin at any time. Plan your risk carefully to avoid the fear of missing out chase.

Asina markets mostly advanced while we slept with only the tech-heavy Hong Kong exchange ending the day down modestly. European indexes trade bullishly this morning as the U.K. posted inflation figures less than expected at 7.9%. With a big day of earnings data, U.S. futures suggest another bullish open in anticipation but remember that can get much better or reverse as the data is revealed. Plan for another wild day of highly emotionally charged trading.

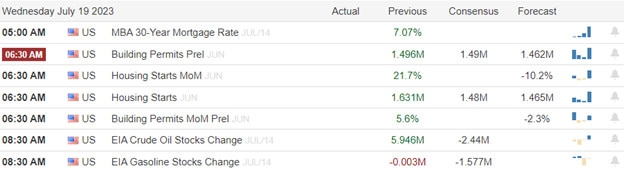

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AA, ALLY, ASML, BKR, CFG, CNS, CCI, DFS, DFX, FHN, GS, HAL, IBM, KMI, LVS, MTB, NDAQ, NFLX, REXR, SLG, STLD, TSLA, USB, UAL, ZION.

News & Technicals’

Microsoft’s stock price soared to a new record high after the tech giant unveiled its latest innovation: an AI-powered add-on for its Office suite. The Copilot service, which will be available as a monthly subscription for $30, promises to enhance the productivity and creativity of Office users by providing smart suggestions, insights, and automation for Word, Excel, and Teams. Analysts estimate that Copilot could boost Microsoft’s revenue by up to 83% from enterprise customers who are willing to pay more for the advanced features.

The US antitrust authorities have issued new rules for assessing the competitive impact of mergers and acquisitions in the rapidly evolving digital economy. The Federal Trade Commission and the Department of Justice Antitrust Division announced that they will apply a more dynamic and forward-looking analysis to determine if a deal harms consumers or innovation. The new guidelines are intended to provide clarity and transparency to businesses and courts on how the agencies evaluate the potential benefits and harms of a merger.

Tuesday started a bit bearish but despite the weak retail sales and industrial production figures stretching the indexes back into an extremely overbought condition with massive enthusiasm. The bulls keyed off better-than-expected earnings from major banks to begin the day and then surged after Microsoft announced a $30 generative AI subscription. Today with a big increase in earnings events, Housing, and Petroleum numbers the bullish enthusiasm may well continue. After the bell today we will get reports from TSLA and NFLX so expect morning gaps to begin as the market reacts. At the risk of sounding redundant raise stops or consider taking some profits and try to avoid chasing stocks that are already extended because a pullback wave could begin at any time due to the short-term overextended conditions.

Trade Wisely,

Doug

Comments are closed.