Tuesday proved to be a choppy low-volume session though the Dow managed a bullish close while the other indexes traded in the red most of the day. While we had some good earnings reports after the bell the sentiment quickly shifted in markets here and around the world after Fitch downgraded the U.S. due to the rapidly growing debit. The downgrade could have serious economic consequences so expect considerable price volatility even as the administration tries to downplay the situation. ADP number will also be in focus this morning as well as a huge round of earnings events for traders to look for buy or sell inspiration.

Overnight Asian markets printed red tapes across the board on the Fitch downgrade of the U.S. with Hong Kong leading the selling down 2.47%. European markets are also decidedly bearish this morning in reaction to the U.S. rating downgrade. Ahead of a big day of earnings, the ramifications of the U.S. downgrade due to the rapidly growing national debt have the bears showing their teeth with the futures suggesting a bearish open.

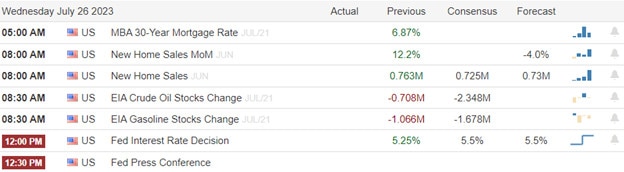

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ALB, ALGT, ABC, APA, ATO, BOOT, BWA, BLDR, BG, CHRW, CCJ, CDW, CF, CAKE, CIVI, CLH, CLX, CTSH, CVS, DISH, DD, EMR, ET, ETR, ETSY, EXC, FICO, FSLY, RACE, FWRD, FDP, GRMN, GNRC, GT, GXO, HLF, HI, HST, HUBS, HUM, IR, JCI, KHC, LMND, LPX, MOR, VAC, MCK, MPW, MELI, MET, MTG, MGM, NRDS, NI, NE, NOG, NTR, OXY, PACD, PK, PYPL, PDCE, PSX, PSA, QRVO, QCOM, RDN, RYN, O, HOOD, RGLD, SMG, SHOP, SPG, SPR, SHOO, SSYS, RGR, SUN, TRIP, UTHR, U, UPWK, WMB, WING, WWE, SYL, YUM, & ZG.

News & Technicals’

The United States suffered a blow to its credit rating on Tuesday as Fitch Ratings downgraded the country from AAA to AA+. The rating agency cited the ongoing political gridlock over the debt ceiling as a reason for the move, saying that it undermined confidence in the country’s fiscal management. The downgrade came after months of warnings from Fitch, which had put the U.S. on negative watch in May. The news rattled the markets, as U.S. stock futures opened lower on Tuesday night.

The U.S. House of Representatives Select Committee on the Chinese Communist Party is probing the role of MSCI and BlackRock in enabling U.S. investments in Chinese companies that are subject to U.S. sanctions or restrictions. The committee sent letters to the two firms on Tuesday, requesting details on how they select, include, and monitor the performance of those companies in their indexes and funds. The committee said it was concerned about the potential risks and implications of such investments for U.S. national security and human rights.

All through the CAT earnings had the Dow edging high the other markets ended slightly lower on Tuesday in a choppy low-volume session. The VIX ended the day slightly higher and the T1222 indicator pulled back reliving some of the over-bought condition. The market seems to be waiting with great anticipation for the earnings from AAPL and AMZN Thursday afternoon. However, Fitch downgraded due to the rapidly growing U.S. debit after the bell yesterday engaged the bears around the world quickly shifting sentiment. The downgrade could have far-reaching economic ramifications despite the fact the administration is attempting to downplay its seriousness. Expect considerable price volatility as the market reacts to the light being shined on the rapidly growing national security threat of the massive U.S. debt and overspending.

Trade Wisely,

Doug

Comments are closed.