With remarkable confidence or irrational speculation ahead of huge market-moving data, the stock market extended gains to begin the week. Today begins the FOMC meeting and we will get the highly anticipated reports from Google and Microsoft with bond yields rising due to pending rate decisions from the Fed as well as other central banks through the week. Expect considerable price volatility watching for intraday whipsaws, reversals, and substantial morning index gaps as the market reacts. Anything is possible with bullish enthusiasm at such an extreme so plan your risk carefully.

Overnight China announced stimulus plans to aid their decorating property market moving all but the Nikkei higher as Hong Kong lept higher closing up a whopping 4.10%. As European markets await an ECB rate decision markets are modestly bullish this morning as earnings keep spirits high. U.S. futures also point to a modestly bullish open reversing some overnight selling with huge anticipation of Google and Microsoft earnings after the bell.

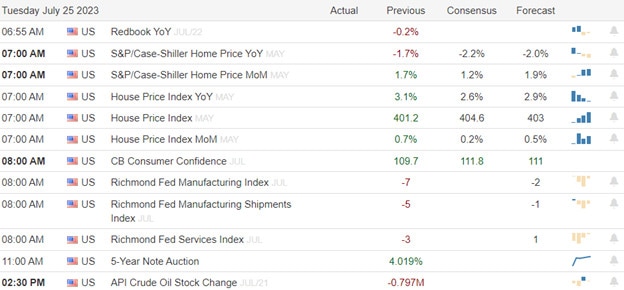

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include GOOG, GOOGL, MSFT MMM, ALK, ACI, ADM, ASH, AVY, BIIB, CALM, CNI, CB, GLW, DHR, DOV, GEHC, GE, GM, IVZ, KMB, LW, MCO, MISCI, NEE, NEP, NUE, NVR, PACW, PHM, SHW, SNAP, SPOT, TXN, TRU, UHS, VZ, V, WM, WFG, and XRX.

News & Technicals’

As China faces a slowing economy amid the pandemic and other challenges, its leaders are preparing to take various steps to stimulate growth and recovery. A high-level meeting of the Politburo, the ruling Communist Party’s top decision-making body, will be held this week to assess the country’s economic performance in the first half of the year and set the tone for the second half. Analysts expect that China will focus on boosting domestic consumption, innovation, and green development, as well as easing monetary and fiscal policies. However, China’s economic slowdown will have significant implications for the rest of the world, especially for commodity exporters and industrial sectors that depend on Chinese demand. Rory Green, chief China economist at TS Lombard, warned that China’s shift away from its traditional growth drivers will also create “second-order impacts” for the global economy in the long term.

The U.S. bond market was under pressure Tuesday as investors awaited the outcome of the Federal Reserve’s two-day meeting that will likely result in a rate hike. The Fed is widely expected to raise its benchmark interest rate by a quarter percentage point on Wednesday, the first increase this year and the sixth since it began normalizing rates in 2015. However, investors are more interested in the Fed’s projections for future rate hikes and its assessment of the economic outlook. The Fed is one of several major central banks that will announce their policy decisions this week, along with the European Central Bank and the Bank of Japan. While the ECB and the BOJ are expected to maintain their ultra-loose monetary policies, investors are looking for clues on when they might start to tighten or taper their stimulus measures. The diverging paths of monetary policy among the world’s leading economies could have significant implications for global financial markets and currencies.

The U.S. stock market extended its winning streak on Monday, with the Dow Jones Industrial Average posting its longest run of gains in more than three years. The market was lifted by strong earnings reports from some of the biggest companies in the energy and financial sectors, which offset the weakness in the utilities and healthcare sectors. The market also shrugged off the mixed performance of global equities due to the political turmoil in Japan and the economic recovery in Europe. Today the market’s focus will be the big reports from the tech giants GOOG and MSFT after the bell. The FOMC meeting begins today, which will likely announce another interest rate hike on Wednesday. However, their guidance on its future policy plans is the biggest uncertainty. With the indexes so extended on tremendous anticipation and speculation wild price volatility is likely so watch for whipsaws, reversals, and morning gaps that could be substantial in the days ahead.

Trade Wisely,

Doug

Comments are closed.