Rock and a Hard Place

The bulls and bears are stuck between a rock and a hard place. First, the bulls become energized, rushing in at any hint or rumor that the Fed may back off on rate increases. Then the bears push right back every time we get reminded of the slowing global economy and the possibility of a severe recession. Then, toss in earnings season, inflation, geopolitical issues, and let the price action mayhem begin. The market-moving giant tech reports that begin this week will likely increase the challenges for the retail trader. Expect overnight reversals and big-point intraday whipsaws, so plan your risk carefully!

Asian markets traded mixed, with the tech-heavy Hong Kong exchange dropping 6.36% and the Yen weakening despite intervention. However, European markets trade green across the board after a report showed business activity slowed. Ahead of a big week of earnings and the PMI report, the pre-market pump is underway, pushing for a gap up open. Plan for another challenging week of high-emotion price action.

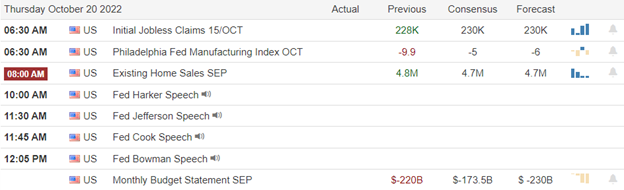

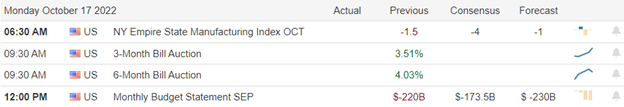

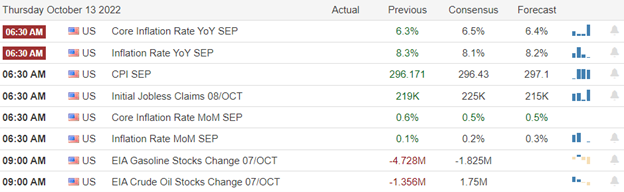

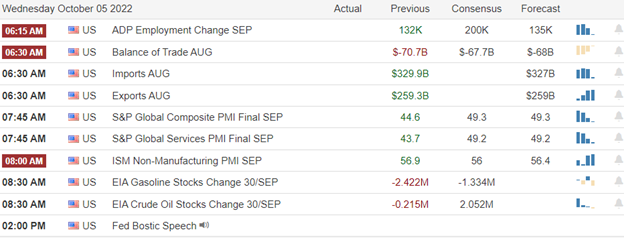

Economic Calendar

Earnings Calendar

This week we really ramp up the number of earnings and begin hearing the results of the market-moving tech giants. Notable reports for Monday include AGNC, BOH, CDNS, CR, DFS, LOGI, PKG, PCH, RRC, SCHN, & ZION.

News & Technicals’

European business activity slows, impacted by high energy costs and raising concerns about a deepening recession. In addition, firms have been under pressure due to higher inflation, mainly from energy costs and wage pressures. “The situation economically is getting worse quite rapidly,” said Chris Williamson, a chief business economist at S&P Global Market Intelligence. The euro lost ground against the U.S. dollar and the British pound during morning deals in London, trading at $0.982 and £0.868, respectively, following the latest PMI data.

Tesla shares slipped in pre-market trade on Monday after the company cut the price of some of its cars in China. The electric carmaker’s shares were down around 3% before the market opened. The starting price for the Model 3 sedan was cut to 265,900 yuan ($$36,615) from 279,900 yuan. The Model Y sports utility vehicle now costs 288,900 yuan versus the previous price of 316,900 yuan.

Former Finance Minister Rishi Sunak looks set to become the next prime minister of the U.K., with votes to be counted Monday afternoon. Former Defense Minister Penny Mordaunt is his only rival after former Prime Minister Boris Johnson pulled out of the race Sunday. Bond yields held steady in early Monday trading, with the 2-year at 4.47% inverted over the 10-year at 4.14%.

The market seems caught between a rock and a hard place, creating challenging and dangerous price swings for the retail trader. Any hint or rumor that the Fed may slow rate increases or pause brings out the bulls and the social media posts shouting that the bottom is in! Then we get economic reports reminding us of the slowing global economy and the fears of a severe recession energizing the very aggressive bears. Toss in all the earnings season hype, and you have the perfect recipe for volatility, whipsaws, gaps, and overnight reversals. Adding to the price action mayhem is all the emotion associated with the tech giant earnings reports that begin in earnest this week. It may be a good time to remember that cash is a position, but if you plan to trade, plan carefully and be prepared for just about anything this week.

Trade Wisely,

Doug