Friday’s price action was highlighted by the INTC disappointment and perhaps a little worry that many of the big tech companies have been priced to perfection with several Mag7 reports pending this week. These huge company reports will be joined by a busy week of economic data that includes an FOMC rate decision on Wednesday and a Friday Employment Situation report. Traders should plan for gap up or gap down market opens on the results of Mag7 earnings, possible big point whipsaws along with overall price volatility that could prove challenging for inexperienced traders.

Overnight Asian market closed mostly higher even as one of China’s largest developers was ordered to liquidate by a Hong Kong court. European market trade mixed this morning after last week’s surge to a two-year high. U.S. futures have recovered off of overnight lows putting on a brave face ahead of a huge week of market-moving data that could create substantial price volatility. Buckle up it could be a wild week ahead.

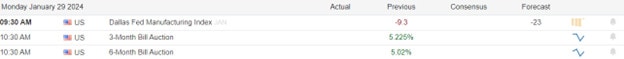

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ARE, CADE, CALX, CLF, CR, ELS, FFIV, BEN, GGG, HLIT, HP, NUE, PPBI, PCH, SANM, SMCI, WHR, & WWD.

News & Technicals’

The stock of China Evergrande, the debt-laden property developer, suffered a sharp drop of more than 20% in the morning session, triggering a temporary trading halt. The plunge came after a Hong Kong court ruled that Evergrande had to repay $260 million to a group of bondholders who had sued the company for defaulting on its obligations. The court decision added to the woes of Evergrande, which had been hoping to reach a last-minute agreement with its foreign creditors over the weekend to restructure its $300 billion debt. However, the talks reportedly broke down, leaving Evergrande on the brink of collapse.

The future of some of the world’s biggest pharmaceutical companies is uncertain, as they face the looming threat of patent cliffs in the next decade. Patent cliffs are the periods when the exclusive rights to sell one or more of their top-selling drugs expire, allowing generic rivals to enter the market and undercut their prices. Bristol Myers Squibb, Merck, and Johnson & Johnson are among the companies that could lose tens of billions of dollars in sales by 2030 due to patent cliffs. However, some of these companies have taken steps to mitigate the impact of patent expirations, such as developing new drugs, acquiring smaller biotech firms, or expanding into new markets.

China is reportedly planning to transfer the control of three of its largest state-owned asset management companies to its sovereign wealth fund, China Investment Corp, in a bid to bolster its financial stability. According to Xinhua Finance, the move would affect China Cinda Asset Management, China Orient Asset Management, and China Great Wall Asset Management, which were established in the late 1990s to deal with bad debts from the banking sector. The plan comes as China faces a severe stock market slump and a mounting debt crisis in its property sector, which has triggered fears of a systemic collapse. By handing over the asset managers to China Investment Corp, Beijing hopes to improve its governance, efficiency, and profitability, as well as to diversify its business scope and reduce its reliance on the domestic market.

Oil prices rose sharply after a series of missile attacks by Iran-backed militants in the Middle East. The attacks targeted a fuel tanker in the Red Sea, causing a fire and a large oil spill, and a U.S. military base in Jordan, killing three U.S. soldiers and wounding several others. The attacks were carried out by unmanned aerial drones, which Iran has been supplying to its allies in the region. The escalation of tensions in the oil-rich region sparked fears of a wider conflict and disrupted the global oil supply.

The U.S. stock market edged down Friday with the INTC disappointment, ending a six-day winning streak. Technology stocks have been leading the rally, lifting the main indexes to record levels, but after Intel reported weak earnings the QQQ is perhaps showing a little worry about the elevation in the tech giants ahead of earnings. Focus this week with be the several Mag7 earnings reports along with the general ramp of earnings numbers. Along with likely earnings volatility, we have a big week of market-moving economic reports that include an FOMC rate decision and the Employment Situation coming Friday. All these things combined with the very high prices in big tech could make for a wild week of price action. Expect big morning gaps, and watch for the possibility of substantial point whipsaws as investors react to all the data.

Trade Wisely,

Doug

Comments are closed.