Wanting to follow through with Friday’s record-breaking surge, Monday began with another substantial gap as the chase higher continues. However, the momentum seemed to fad rather quickly with investors perhaps showing a little caution with key inflation data coming Thursday morning. Today will be all about the earnings results as the number of reports ramps up which will capped by the highly anticipated Netflix report after the bell. Be prepared as price volatility typically picks up during the bulk of earnings and there are some big point moves possible so plan carefully.

While we slept Asian markets reversed early losses to close mostly higher as China mulls a massive stock market rescue package as disinflation and consumer weakness grow. European markets trade flat to slightly bearish this morning resting after recent gains. U.S. markets also suggest a mixed but rather flat open coming off of overnight lows with a busy day of earnings ahead.

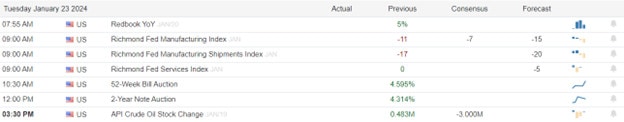

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include NFLX, MMM, CNI, DHI, GE, HAL, ISRG, IVZ, JNJ, LMT, ONB, PCAR, PG, RTX, SYF, STLD, LRN, TECK, TXN, TRMK, VBTX, VZ, & WSBC.

News & Technicals’

China’s economic outlook is bleak, according to Shaun Rein, founder of the China Market Research Group, who has been living in China for 27 years. He told CNBC on Monday that he has never seen such low confidence among consumers and businesses in China. He predicts that China will go through at least another 3-6 months of economic hardship, as it struggles to rebound from the impact of Covid-19. China, the second-largest economy in the world, has failed to meet its growth expectations in 2023, despite lifting pandemic restrictions.

The Fed’s Office of Inspector General released a report on Monday that criticized the trading activities of two former regional presidents, Robert Kaplan of Dallas and Eric Rosengren of Boston. The report found that their trades, which involved stocks, bonds, and futures, created conflicts of interest that compromised their independence and integrity as central bank officials. The report also said that their actions violated the Fed’s code of conduct and ethics policies, and undermined the public’s trust in the Fed.

The SEC, the U.S. regulator of the securities markets, revealed that a SIM swap attack was behind the hacking of its official account on X, a social media platform. On Jan. 9, a hacker managed to take over the @SECGov account and posted a false message saying that the SEC had approved the first spot bitcoin ETFs, which are funds that track the price of bitcoin and trade on the spot market. The hacker was able to do this by swapping the SIM card of the phone number linked to the account and resetting the password. The SEC admitted that it did not have two-factor authentication enabled, which would have added an extra layer of security to the account.

The stock market kicked off the week bullish with another substantial gap up but then struggled to continue the upward perhaps acknowledging the uncertainty of the inflation data later this week. Bond yields have also nudged higher suggesting some concern and caution by investors about the pending Thursday data. The Nasdaq has gained about 2.0% since the start of the year, mostly due to the Magnificent 7 stocks (Apple, Microsoft, Google, Amazon, Tesla, NVIDIA, and Meta) which have increased by an average of 3.9%. However, the Russell 2000 small-cap stock index has fallen by over 3.0% this year, even though it had more strength at the end of 2023. With very little to nothing on the economic calendar today investors will be looking to the growing list of earnings reports for inspiration. The Netflix report will be of particular interest after the bell today. Earnings typically mean a ramp up of price volatility so plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.