Tuesday turned out about as one would expect with a healthy dose of hesitation and caution ahead of big tech reports and an FOMC decision scheduled for 2 PM Eastern this afternoon. Earnings reports from MSFT, GOOG, and AMD produced mixed results but all creating a bearish opening in the Nasdaq this morning. With a busy day of earning and market-moving economic reports expect challenging price volatility as we wait for Jerome Powell and his merry band of academic’s interest rate decision and press conference.

Overnight Asian market traded mixed but mostly lower as Australia hit a new record high while at the same time China closed at a 5-year low after weak manufacturing data. European markets trade mostly higher with modest gains and losses as they cautiously wait on the U.S. rate decision. U.S. futures also point to mixed open with the industrials suggesting bullishness with the tech sector is challenged by bearishness as traders react to big tech results.

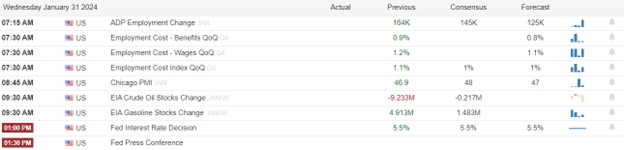

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include APTV, ADP, AFL, AEM, AGI, ALGN, AVB, BA, BSX, EAT, CHRW, CP, CLB, CTVA, DGII, EVR, EXTR, FLEX, FTV, GSX, HES, HESM, HESM, KLIC, LII, MA, MTH, MEOH, MET, MTG, NDAQ, NYCB, NTR, ODFL, PSX, PTC, QRVO, QCOM, RYN, ROK, ROP, SLAB, TTEK, TEVA, TMO, TRI, UGI, VSTO, & WFG.

News & Technicals’

Alphabet, the parent company of Google, beat the market expectations on both revenue and profit for the fourth quarter, but its ad revenue fell short of the estimates. The company attributed the lower ad revenue to the impact of the pandemic and the regulatory pressures on its online advertising business. Alphabet also reported a $2.1 billion charge for 2023, related to the layoffs it made last year to cut costs and streamline its operations. Despite the challenges, Alphabet shares have risen 56% in the past year, excluding the decline in the after-hours trading.

Microsoft delivered better-than-expected results for the fourth quarter, as its Azure cloud business grew faster than the market anticipated. The tech giant also announced its biggest acquisition ever, buying Activision Blizzard, the maker of popular video games such as Call of Duty and World of Warcraft, for $68.7 billion. However, Microsoft gave a cautious outlook for the current quarter, as it faces supply chain challenges and increased competition in the cloud market.

AMD, the chipmaker that produces graphics processing units, or GPUs, reported a strong quarter, driven by the demand for its products in the field of generative artificial intelligence. GPUs are essential for creating and running AI models that can generate realistic images, sounds, and texts. AMD faces stiff competition from Nvidia, the leader in the GPU market, but it claims that its new AI chips, launched last year, can rival Nvidia’s H100 GPUs in some use cases. AMD said that its server GPU sales, which cater to the cloud and data center customers, grew significantly during the quarter.

Walmart, the world’s largest retailer, declared a three-for-one stock split on Tuesday, meaning that each shareholder will receive two additional shares for every share they own. The company said that the new shares will be distributed on Feb. 23, after the market closes, to the shareholders who owned the stock as of Feb. 22. The stock split will lower the price of each share, making it more affordable for investors. Walmart’s stock closed Tuesday at $165.59, close to its record high of $169.94 that it reached in November.

The stock market ended the day mixed with some hesitation and caution as we waited for big tech reports and the pending FOMC decision. The JOLT’s report exceeded expectations adding a touch of uncertainty because the Fed continues to be concerned with getting some balance in the jobs market. Short-term yields rose after the encouraging consumer confidence and labor-market reports. The 2-year Treasury yield increased to 4.36%, while the 10-year yield stayed around 4.05%. Today we have a busy day of earnings with Mortgage Apps, ADP, Treasury Refunding, Employment Costs, Chicago PMI, Petroleum Status, with an FOMC rate decision and press conference to inspire the bulls and bear. Expect considerable price volatility and watch for the potential of some big point moves in the indexes as we wrap up the month.

Trade Wisely,

Doug

Comments are closed.