28,000 Breached

In a last-minute surge of bullishness, the Dow close 4 points over 28000 as new records in three of the four major indexes created history. The poor small-cap Russell continues to lag way behind, under-loved, and struggling with resistance. Positive news on the Phase 1 trade deal negotiations has the market once again gaping higher as the bulls continue to show no fear of heights. With Fed signaling a rate-cutting pause and earnings season, winding down the market may become more sensitive to trade developments and news out the impeachment hearings. Remember, big round numbers such as 28,000 will likely see a test as support in the not to distant future, so remain flexible and focused on price action.

Overnight Asian markets closed green across the board despite the increasingly violent protests in Hong Kong choosing to focus on US/China trade hopes. European markets are mostly flat and mostly lower this morning, taking a much more cautious approach to trade news. However, US Futures are tossing caution to the wind looking to extend Friday’s record-breaking rally with a Dow gap up open of more than 75 points. The possibility of a pop and drop exists, so consider your risk carefully if you chase the open.

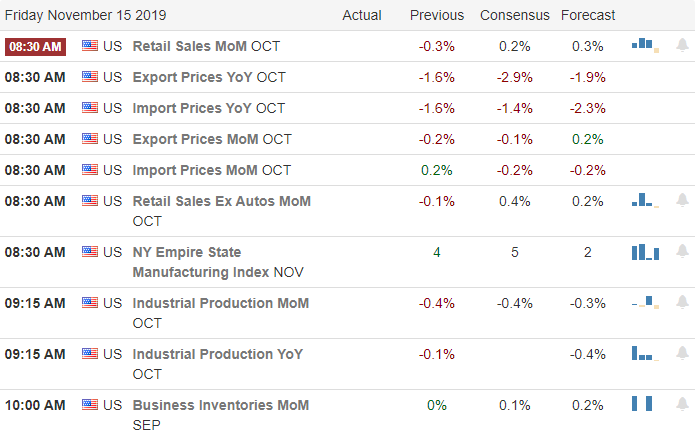

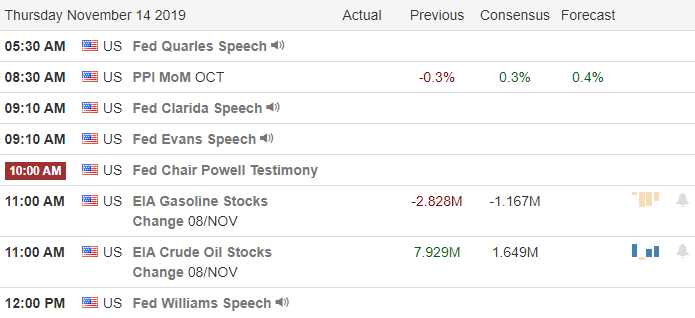

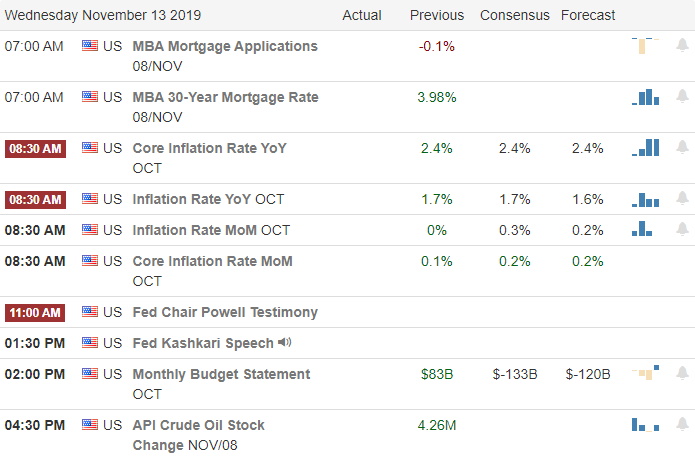

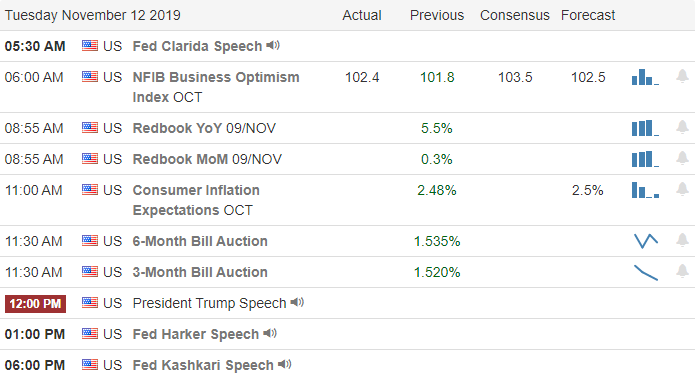

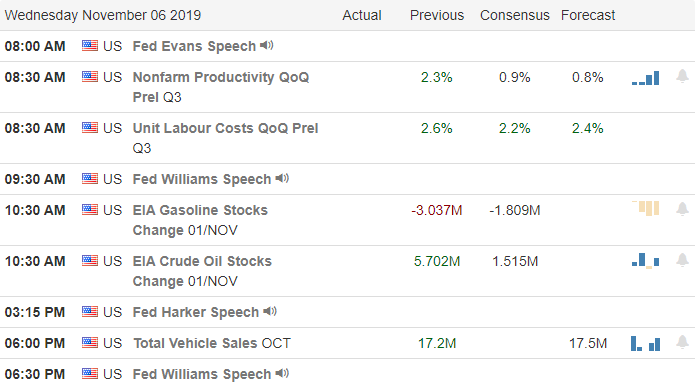

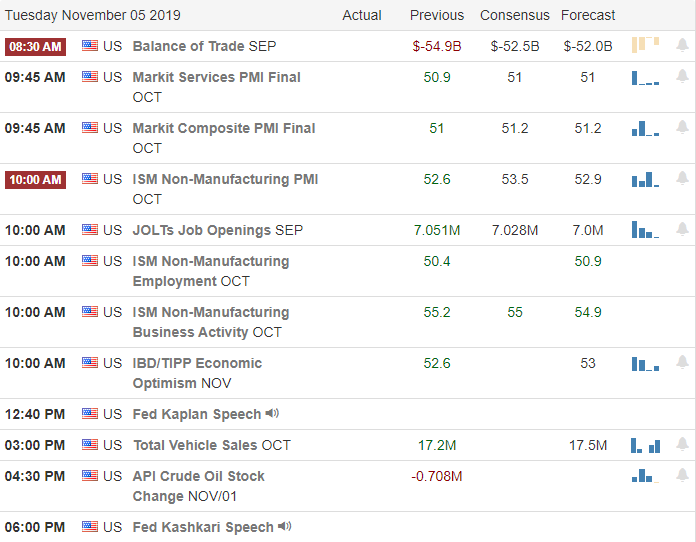

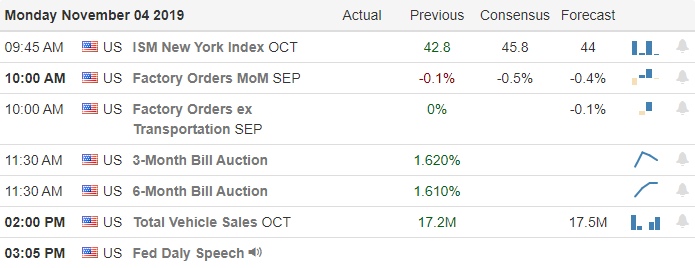

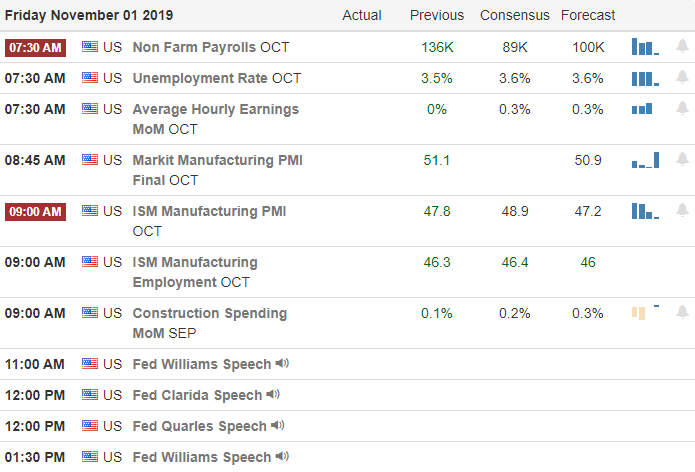

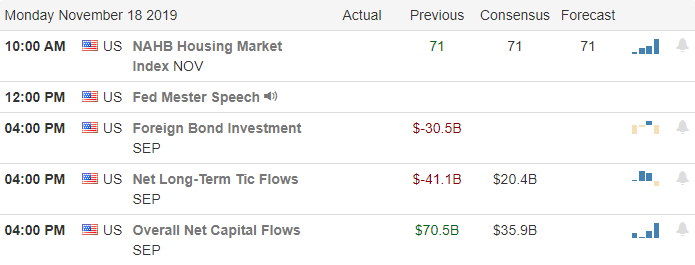

On the Calendar

On the Monday Earnings Calendar, we just over 50 companies reporting results. Of the companies reporting, MANU is the only one that I see as particularly notable.

Action Plan

The big move Friday looks to have additional inspiration this morning after a report of a productive meeting on the Phase 1 trade deal. With the majority of earnings reports now behind us, we still have about 200 companies reporting this week. The majority of the notable reports will be in the retail sector, with HD kicking it off tomorrow morning. As Impeachment hearings enter their second-week traders will have to keep on eye on the news for possible market-moving reports spun-out of by the political drama.

On Friday, the Dow closed above 28,000 for the first time while the DIA lagged slightly behind at 279.84. Big round numbers can sometimes be a stumbling block for the market, but the SP-500 cut through 3100 like warm butter and the Nasdaq lept right though 8500 like it wasn’t even there. That in mind, be careful chasing the morning opening gap. Testing these big round numbers as support is not out of the question in the near future, so as always remain focused on price action for clues. With earnings winding down and the rate-cutting, Fed pausing inspiration may turn to the Phase 1 trade deal hopes and making the market very news sensitive.

Trade Wisely,

Doug