We could have an interesting market day as the events on Capitol Hill unfold. We have the Jerome Powell testifying in Congress as the House begins the Presidential impeachment hearings. We can expect a belly full of political drama and possibly news-driven price action to keep us on our toes. If that’s not enough for the market to digest trade war uncertainty has once again raised its ugly head bring out the bears this morning ahead of the 8:30 AM CPI report.

Asian markets closed in the red across the board as the civil unrest in Hong Kong, and trade uncertainty woke up the bears. European markets are also decidedly bearish this morning, seeing nothing but red across their major indexes. US Futures point a gap down open this morning ahead of earnings reports, CPI, and full-day of Capitol Hill drama. Stay focused on price action and prepare for the possibility of new driven reversals.

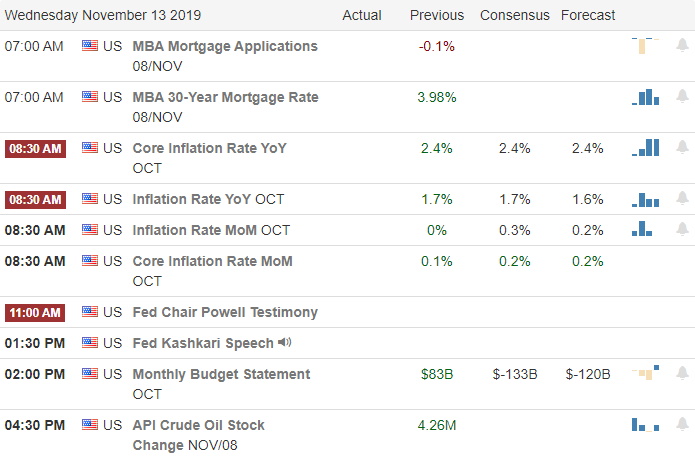

On the Calendar

On the Earnings Calendar, we have more than 160 companies reporting results. Notable reports include CAE, CSCO, CPA, ENR, FVRR, LK, NTAP, QIWI, SSYS, TNK, TSEM, and VIPS.

Action Plan

Today will be a very busy day on Capitol hill and could spill over into market price action. Chairman Powell will testify before the Joint Economic Committee just a day after the President suggests the US should have negative rates like other countries have. That could set the stage for some interesting conversation and questioning by the committee. Meanwhile, in the house chamber they Nancy Pelosi will begin the presidential impeachment hearings that are not only likely to move the market but also provide Saturday Night Live plenty of comedic inspiration.

Technically speaking, the bulls continue to demonstrate their resiliency in spite of all the political lunacy and uncertainty it faces. This morning it would appear that the bears are trying to reengage as trade war uncertainty once again floats to the surface affecting prices in Asia and Europe during the night. After the morning gap down I would not be surprised to see the price action become light and choppy as we wait for the news-driven events of the day come to light. Remain focused on price action and flexible as market direction could quickly shift in reaction.

Trade Wisely,

Doug

Comments are closed.