Thank You, Mr. Fed,

💲 You really gotta love the business of trading, while sitting in the doctor’s office yesterday. I bought the GDX Sept. $25.50 Calls, up nicely today. ROKU had a bullish Pop Out of The Box pattern yesterday up 22% yesterday and looks like we get more today. SNAP is still trending currently up 25.7%.

All buys and closes announced in the HRC Live Trading Room, be sure to tune in starting at 9:10 Eastern when I’ll review the market, trade ideas.

Have good trading day – Rick

Pre-Market Thoughts

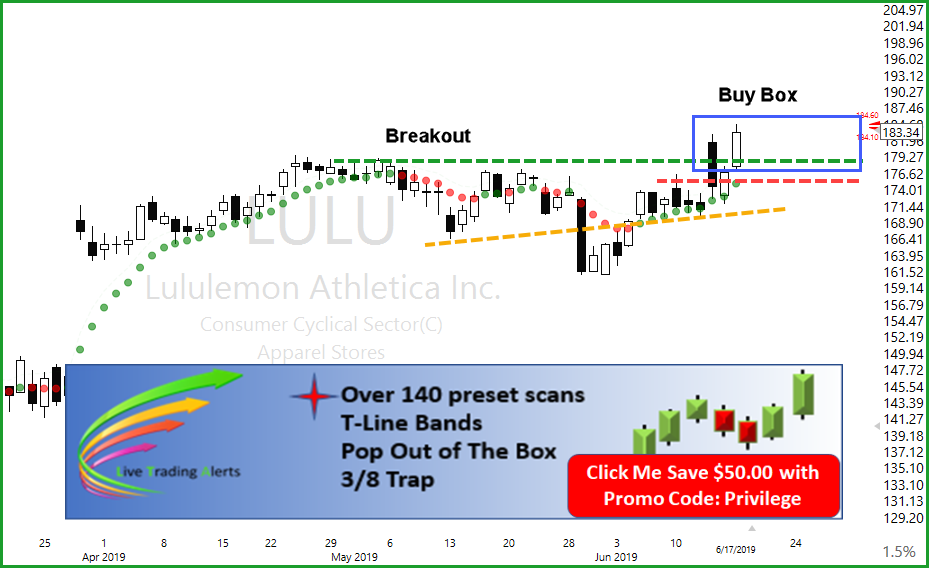

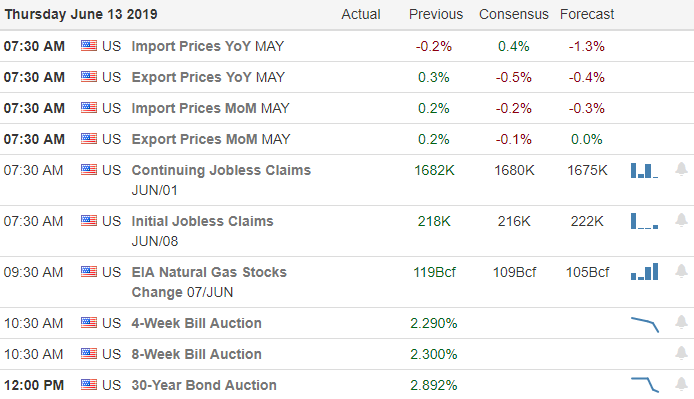

Thank you, Mr. Fed, and the market, thanks to you. It seems based on the market action it is pleased with the remarks from Mr. Powell. The SPY held well yesterday and looks to be gapping up today. (Remember gaps can be gifts) And profiting or some profiting into strength has worked great for my trading strategy over the years; we call that base hits. The new number for the SPY to beat is $294.95, beat means breakout and hold. A great way to follow the trend of the SPY is with price action (candlesticks) and the T-Line chain. The VIX is still trending down based on the price leading the T-Line chain down. Two charts I have on one of my screens is the VXX and FNGU chart, they are helpful with being one with the market.

Trade Ideas

🎯 ELY is setting up; ELY Callaway has gapped up over resistance recently and currently forming a continuation chart pattern. There is always a possible entry on the building of the chart pattern, but the money and the bullishness starts when price action is above $18.30. Remember to wait for the (QEP) Quality Entry Pattern for best results.

🍰 The LTA Alert Scanner and TC2000 are my tools of choice because they work!. Rick and the HRC Members kick off the trading room starting at 9:10 Eastern We review the market, and today’s trade ideas. ELY, SHOP, BX, MDR, ETSY, SPOT, LSCC, SBUX, CPRT.

✅ A Traders Edge In All Markets

The LTA Scanner can filter out charts that are trending, up or down and alert on charts that have Candlestick signals and patterns, western patterns and when indicators, such as MACD, Stochastics, RSI or Bollinger Bands have crossed or reaches the desired level. 😎 One of my favorites is the T-Line Band Scan. The right tools for the job.

We use The Worlds Best Trading Tools, TC2000 for charting, LTA-Live Trading Alerts for real-time price action, candle and candle patterns, and western patterns. The right tools for the right job.👍

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service