A 90-day grace period added to the technology ban with Huawei has the lifted the spirits of the futures market this morning and relieved some of the strong selling pressure in the NASDAQ. Futures are pointing to more than a 100 point gap up open in the Dow and the NASDAQ is showing at least a partial recovery of yesterday’s rout. However there is still significant technical damage in the charts and with US/China negotiations stalled, repairing the damage could take some time.

Price action continues to be very challenging with what seems almost daily overnight reversals and big gaps. Swing traders are likely finding it very difficult to maintain an edge of any kind as the volatility favors the quick in out of day trading avoiding the overnight risk. Remember don’t fight the market and don’t trade just to have something to do. Remain disciplined to your trading plan and profit your capital until your edge returns.

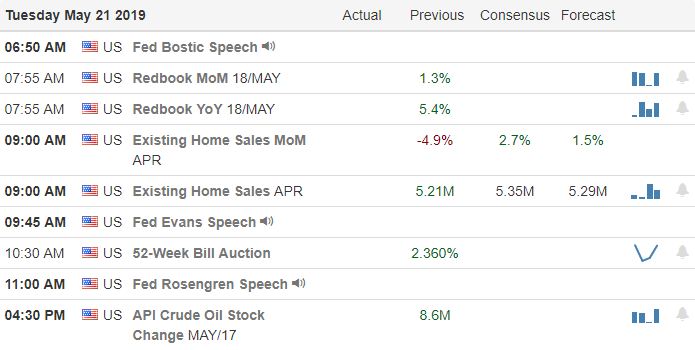

On the Calendar

On the Earnings Calendar we have more than 70 companies reporting with a big emphasis in retail for the rest of the week. Among the notables today, KSS, JWN, CRMT, EV, HD, JCP, TJX, TOL and URBN,

Action Plan

After the close yesterday a 90 day grace period was added to the Huawei blacklisting to relieve some pressure on the US tech companies. This exemption allows Googe to send software updates to Huawei phones which use its Android operating system through August 19th. As a result NASDAQ futures are recovering substantially this morning and lifting the spirits of the other major indexes as well.

Unfortunitually the divide between the US and China trade negotiations seems to have grown and according to reports the trade war could get worse before it gets better. Despite that US futures are pointing to a positive open this morning but keep in mind there is still significant technical damage in the charts that will likely take some time to repair. The overnight reversals and volatility continue to favor the very nimble day traders and making it challenging for swing traders to matain an edge of any kind.

Trade Wisely,

Doug

Comments are closed.