I don’t know about you but I am becoming weary and frustrated with the daily overnight gaps and this morning we have another big one. Asian markets closed lower across the board as the country stepped up their rhetoric increasing trade war tensions and elevating market fears that this could go on and on. European markets are currently trading in red across the board as well with their added political uncertainty.

As a result the US futures point to a Dow gap down of more than 200 points at the open with the tech sector getting hit particularly hard. As always we must be careful not to chase the gap but wait patiently to see if sellers support the gap or if this another bear trap as we’ve experienced several times during this downtrend. With all the overnight gaps and reversal swing traders have little to no edge and although the price action has been very challenging it currently favors experienced day traders. Be very careful and remember a big part of a traders job is to protect your capital and if you have no trading edge then that becomes job number one!

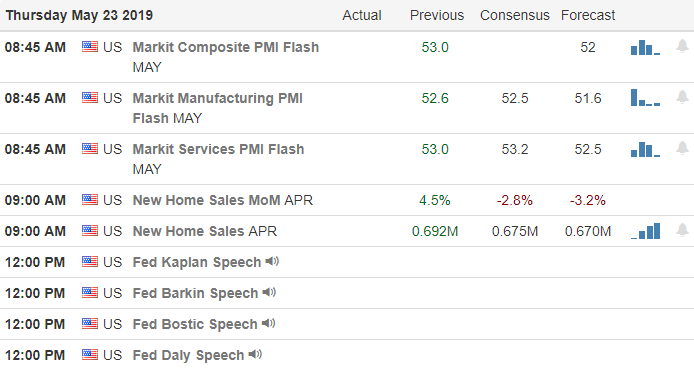

On the Calendar

On the Earnings Calendar we have over 50 companies reporting results today. Notable reports include, BKE, DXLG, FL & HIBB.

Action Plan

Another day another overnight gap and today it’s a doozie as trade war tensions grow. Over the last few days there has been a growing hope that the indexes could recover their 50-day moving averages. Unfortunitually, today’s gap down confirms the failure a raises the odds of a retest of May lows and the possibility of even a deeper selloff. The current rhetoric coming from both countries suggests this stalemate in negotiations could be long-lasting.

As with any large gap be careful not to chase it short. We must be patient making sure sellers support the gap after the open. This morning’s move certainly has the potential to create some panic selling so keep an eye on the VIX if it begins to spike. In the last couple of weeks we have also seen large morning gaps bring in the bulls to defend the morning low creating a significant rally. Of course to this point those rallies have not proved to hold but has it has made this market downtrend particularly challenging for traders. Day traders have the upper hand in the current market as the daily reversal gaps make it nearly impossible for swing traders to have an edge.

Trade wisely,

Doug

Comments are closed.