Jobless Claims Today UK Raises Forecast

Markets gapped higher marginally at the open Wednesday. From there, the large-caps vacillated sideways all day, while the QQQ dols off after the morning grind. This left us with a shooting star type candle (new all-time high close) in the DIA, and black candles in the SPY and QQQ. On the day, SPY gained 0.03%, DIA gained 0.23%, and QQQ lost 0.34%. The VXX fell 2.5% to 39.19 and T2122 rose, but remains outside the overbought territory at 75.14. 10-year bond yields fell significantly again to 1.57% and Oil (WTI) fell six-tenths of a percent to $65.30/barrel.

PTON lost 14.56% on Wednesday after announcing the recall of all their treadmills due to the risk of death. During the afternoon, SEC Commissions Gensler told Congress that he has a team studying the gamification of trading caused by features of brokerages like Robinhood. He also raised concern about the flood of orders that are routed through Citadel, VIRT, and a few other “order buyers.” He followed this by stating that he has asked the SEC staff to solicit public comment (a pre-requisite step to changing regulations on brokerages). So, action may be on its way…slowly.

After the close, Fed member Clarida told CNBC that he feels the Fed is a long way from the goals they have set and are therefore a long way from tightening policy (regardless of Treasury Sec. Yellen’s Tuesday statement). While certainly not definitive, this is an indication the Fed is signaling it will remain independent (or at least wants to be seen as independent) of comments and opinions of government entities. In unrelated central-bank news, the Bank of England has announced that it expects UK growth to surge 7.25% this year (a 2% increase over the previous 5% forecast and slightly above market analyst estimates for the revision).

Related to the virus, US infections are rising again after plateauing at a level above the fall level. The totals have risen to 33,321,244 confirmed cases and deaths are now at 593,148. The number of new cases has ticked lower again and are back down below last summer’s peak to an average of 47,945 new cases per day. However, deaths are still plateauing at the new lower levels, now at 718 per day. MRNA announced after the close that unpublished early testing from an ongoing trial is indicating that a booster shot of their vaccine is showing promising immunity results against the South African and Brazilian variants. (No word on the “617” double-mutation variant that is ravaging India now.) In no so good news, the CDC announced Wednesday that the number of vaccine doses administered is now 20% lower than one week ago, despite more than adequate supply. This problem is highlighted when CVS announced they are now taking walk-ins for vaccination at more than 8,300 retail locations.

Globally, the numbers rose to 155,922,329 confirmed cases and the confirmed deaths are now at 3,258,293 deaths. The trends have reversed and are now trending toward trouble again as we have seen significant upticks recently. The world’s average new cases seems to have topped again at the new all-time peak and is now rounding over at 800,022 new cases per day. Mortality, which lags, may also be rounding over again at 13,085 new deaths per day. The catastrophe in India continues as the country reported yet another peak of over 412,000 cases (which is staggering since most experts believe this to be an undercount by a magnitude of at least 3 times). However, in some good news, a study out of Qatar shows the existing PFE-BNTX vaccine is effective against the same 2 variants, but like with the MRNA news, no mention of the news “double-mutation” (617) variant.

Overnight, Asian markets were mixed, but leaned to the green side. Japan (+1.80%) and Thailand (+1.46%) led the gains while Shenzhen (-1.58%) and New Zealand (-0.75%) paced the losses. In Europe, markets are also mixed and mostly flat on very modest moves so far today. The FTSE (+0.21%) is the exception, making a bigger move on the new BOE growth forecast. However, the DAX (+0.05%) and CAC (+0.07%) are more typical as of mid-day. As of 7:30 am, US Futures are pointing to a flat, if slightly green open (at least before economic data releases). The DIA is implying a +0.15% open, the SPY implying a +0.13% open, and the QQQ implying a +0.20% open.

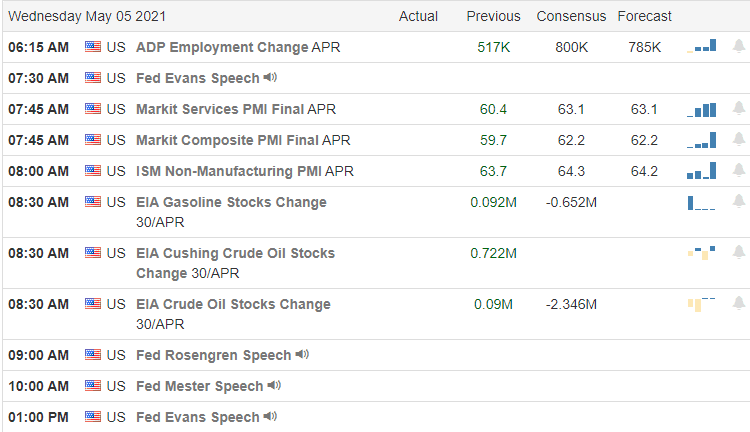

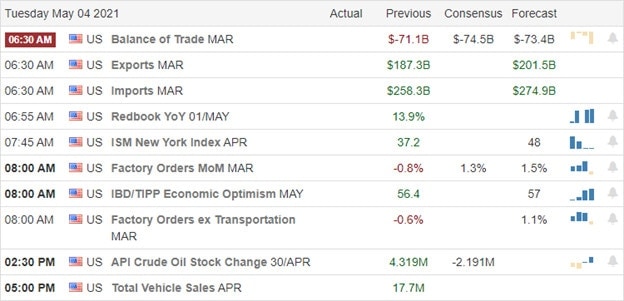

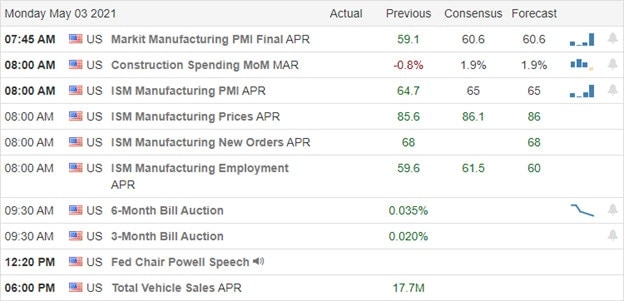

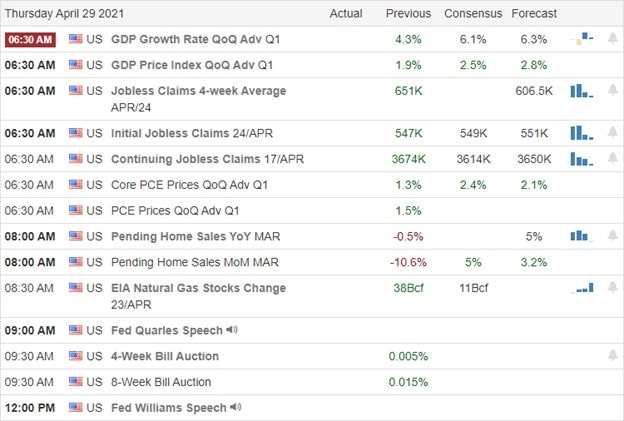

The major economic news scheduled for Thursday is limited to Weekly Initial Jobless Claims, Q1 Productivity, and Q1 Unit Labor Costs (all at 8:30 am) and 4 Fed speakers (Williams at 9 am, Bostic and Mester at 1 pm, and Kaplan at 6:05 pm). Major earnings reports on the day include GOLF, AHCO, ADNT, AES, ABEV, BUD, APTV, MT, ARW, AVYA, BLL, BDX, BV, BIP, BLDR, CNQ, CAH, CNP, COMM, XRAY, UFS, SATA, EPC, EPAM, AVRG, EXPI, FIS, FLIR, HAIN, HWM, HII, IIVI, NSIT, IRM, K, KL, KTB, LIN, MGA, MMS, MDU, NIDD, MRNA, MUR, NJR, NLSN, NOMD, NRG, OGE, OPCH, PAE, PZZA, PENN, PRMW, PWR, REGN, SBH, SRLP, SUN, TPR, TRGP, TEN, TMX, BLD, THS, VNTR, VIAC, VSTO, VNT, W. WCC, and ZTS before the open. Then, after the close, AL, AQN, LNT, AIG, COLD, AMN, BECN, BKD, CVNA, ED, CVET, BAP, CWK, DBX, ENDP, EOG, EXPE, FND, FNF, FRG, IAC, IHRT, MTZ, MCK, MTD, MCHP, MNST, MSI, NFG, NWSA, OTEX, CNXN, PTON, PFSI, POST, QDEL, RGA, REZI, ROKU, SEM, SWX, SFM, SQ, TDS, TDC, TSE, and USM report.

The bulls tried and were met with immediate resistance Wednesday. The high-tech Nasdaq was protected especially strongly by the bears as the QQQ now looks to be in a definite pullback and trying to test support. Meanwhile, the large-caps remain in that sideways range they have been stuck in for going on 3 weeks. As I’ve said, indecision and chop are not a good environment for most traders. So, continue to be very careful, hedged, and/or nimble.

Remember, you don’t have to trade every day or every week. The first rule of successful trading is “don’t lose money,” not “trade every day.” So, respect potential support and resistance levels, but you don’t have to assume they will hold. Just keep locking in your profits when you achieve your trade goals and maintain your discipline by following those trading rules. Stick with the trend, but also avoid chasing trades you have missed. Don’t let your emotions get the better of you. It is consistency that is the key to long-term trading success.

Ed

Swing Trade Ideas for your consideration and watchlist: No trade ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service