After Monday’s big jobs pop and waiting on the FOMC minutes, the bulls took a siesta yesterday, largely chopping sideways. Though we are likely not learn anything new in the minutes of the last Fed meeting, all eyes will be looking for clues for changes in their extremely dovish stance coming under fire due to inflation worries. With the 2nd quarter earnings season set to begin next week, don’t be surprised to see the choppy price action continue.

Asian markets closed mixed overnight, with the HIS slipping nearly 1%. European markets trade mixed with mostly modest price action across the board. After a decline of 20% in mortgage refinance demand, the U.S. has softened from early morning highs, currently suggesting a flat to modestly bullish open as we wait for the Fed minutes.

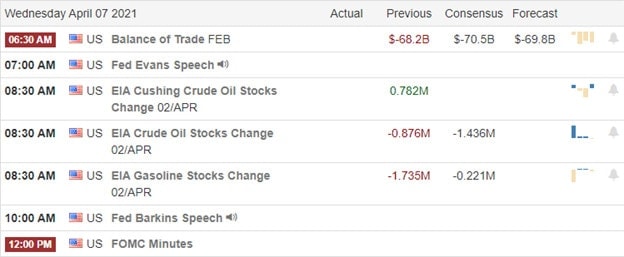

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have just ten companies listed, though several are unconfirmed. Notable reports include LW, MSM, & SCHN.

News & Technicals’

Markets took a siesta yesterday, waiting on the FOMC minutes. According to reports, second-quarter numbers will likely surge, and many believe the Fed will come under considerable pressure for maintaining its extremely dovish stance. Economists expect a 9% growth in the second quarter that could trigger strong inflation concerns. Though I doubt we learn much more than we already know, all eyes will be on the FOMC minutes looking for clues later this afternoon. Jamie Dimon chimed in to let us know that the expected economic boom is fueled by deficit spending. Thank you very much, captain obvious! Jeff Besos says he supports a hike to the corporate tax rate even though Amazon has come under fire for paying very little in taxes over the past years.

Technically speaking, the indexes are in good shape though perhaps a bit dangerous because of the overstretched condition. The QQQ has rallied sharply up more than 8% in just 9-trading days yet still has overhead resistance to overcome. With the softness experienced in the financial sector and energy sector yesterday, the IWM seemed to struggle and now shows us a possible head and shoulder pattern to keep an eye on. Ahead of the FOMC minutes, the 10-year treasuries continue to moderate, but this could be a temporary situation should the second-quarter numbers confirm inflation concerns. Keep in mind with the kick-off of earnings season just a week away, it could be possible to see choppy consolidation price action in the indexes as we wait for the inspiration.

Trade Wisley,

Doug

Comments are closed.