Credit Suisse reported a $4.7 billion hit as the Archegos fallout continues. However, Treasuries show a little softness this morning, a day after the DIA and SPY leap to new record highs. Oddly, as the markets buzzed with bullish energy, the oil stocks suffered declines as rising pandemic infection rates raised futures demand worries. Another puzzling contradiction is seeing the VIX move up with the indexes. The moral of the story, stay with the bullish trends but don’t become complacent.

Asian markets displayed some wild contradictions last night as the NIKKEI declined 1.30%, and the HSI surged up 1.97%. European indexes are in rally modes on recovery hopes across the pond even as Credit Suisse cuts dividends to the hedge fund losses. U.S. futures seem to be taking a hiatus this morning point to modest declines ahead of the JOLTS report and light day of earnings. Let’s get ready to rumble!

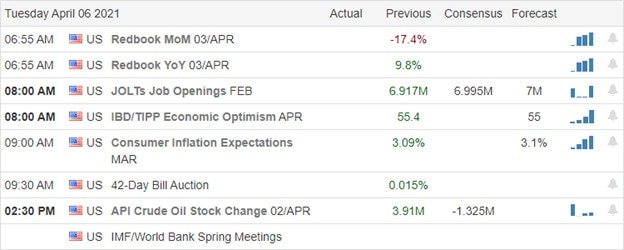

Economic Calendar

Earnings Calendar

In a light day on the earnings calendar with only eight verfied companies fessing up to quarterly results. I made a mistake looking at Tuesday’s notable reports thinking I was going over those on Monday. As a result, I will have to repeat yesterday’s stocks, LNN, MAXN,& PAYX.

News & Technicals’

The Archegos hedge fund scandal with Credit Suisse reporting a $4.7 billion loss as the fallout continues. To pass the Biden $2.3 trillion infrastructure plan Senate Leader Schumer will use budget reconciliation to pass the legislation without Republican votes, setting up another distracting political battle. Google announced it would stop using Oracle’s finance software in favor of the SAP. ORCL is indicated slightly lower this morning. Craig Irwin, a senior analyst at Roth Capital, placed a price target of $150 for Tesla. Tesla closed at $690.57 yesterday, suggesting a 78% haircut if Irwin is correct. In a bit of good news, Treasury yields are pulling back this morning, but I think it would still be wise to keep an eye on them as Congress works to print another $2.3 trillion in deficit spending.

The DIA and SPY printed fresh new record highs as recovery hopes energized the bulls. Interestingly oil stocks suffered yesterday as worries about the rising pandemic infections rates across the country could affect demand. Seemingly a direct contradiction to the overall market bullishness. Another puzzling contradiction is that the VIX moved higher yesterday at the same time the indexes were surging with bullish enthusiasm. Things that make you say, hmm? The QQQ continued its very steep rally yesterday but keep in mind there remains overhead price resistance to be dealt with before the all-clear can be sounded. Remember that it’s not unusual for the market to become a bit light and choppy as we wait for the FOMC minutes coming out tomorrow. However, the JOLTS report could keep the fires burning through the morning session.

Trade Wisely,

Doug

Comments are closed.