While traders enjoyed a three-day weekend, the jobs report blew past consensus expectations adding 916,000 in March. That has the bulls working hard in the premarket point strong bullish open to follow the light volume but record-setting Thursday close. On the bullish side, the VIX is finally breaking down, but on the bearish side, treasuries ticked higher as inflation worries continue due to the vastly stronger than expected jobs number. Though we will set new records at the open, be careful not to chase already extended stocks.

Overnight Asian markets rallied to close green across the board, with the HIS leading the way, up 1.97%. European markets are also showing modest bullish across the board this morning, with tech shares gaining favor. Ahead of a light day of earnings & economic reports, the U.S futures point to a substantial gap up of more than 200 Dow points. Buckle up; it could be a somewhat volatile price action morning.

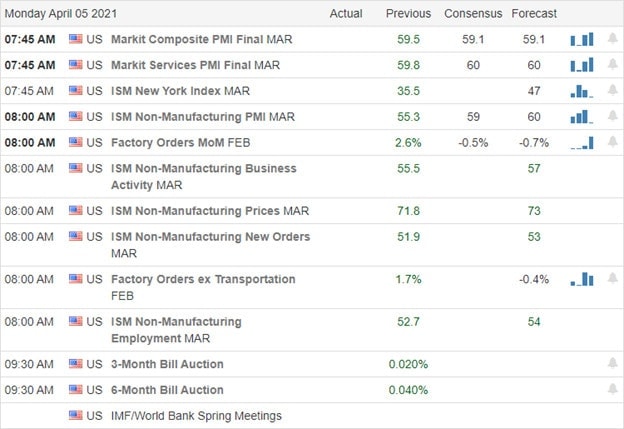

Economic Calendar

Earnings Calendar

We have 23 companies listed on the earnings calendar to kick off this week, but there are only 3-verified. Notable reports include LNN, MAXN, & PAYX.

New & Technicals’

During the Friday Easter shut down, the monthly government jobs report blew past the expectations, with payrolls jumping 916,000 in March. As a result, the U.S. Treasury yields edge higher in reaction to the strong jobs report’s performance due to inflation worries. Senator Roy Blunt on Sunday urged President Biden to cut his $2 trillion infrastructure plan to $615 billion with a focus on rebuilding physical infrastructure. Kevin O’Leary, chairman of O’Leary ETFs, calls for the U.S. to be “extremely aggressive” to level the playing field with China. He says that could include delisting Chinese stocks and shutting Chinese companies out of the U.S. court system. I suspect we will hear a lot more about this subject in the near future as tensions between the U.S. government & businesses grow against Chinese practices.

Although a light volume day, the SP-500 found a path to a new record high, topping 4000 for the first time in history. The Dow set another new record as well as the QQQ and IWM lagged behind. With the strong jobs report and the anticipation of a bullish 2nd quarter earnings season, the bulls should have the upper hand as long as inflation worries stay in check. With the DIA and SPY working together again, the lagging QQQ is less of a concern, but it would wise to respect the overhead resistance if bonds continue to rally. With the VIX finally falling below support levels, perhaps, we can get past some of these wild whipsaws and get a bit more confidence in the price action. Unfortunitually, the T2122 indicator is already in a short-term overbought condition, with the gap up this morning suggesting an extreme extension, so be careful not to chase already extended stocks in fear of missing out.

Trade Wisely,

Doug

Comments are closed.