Unemployment Soars

After receiving the worst unemployment number in history, the market chose to focus on the coming 2-trillion stimulus bill extending the bullishness for a 3rd day. The rally recovered some important price levels of support, but not the question is, will they hold heading into an uncertain weekend. With the US now with the highest number of confirmed infections and the 2nd quarter earnings season just around the corner, there is still a lot of fear in the market.

Asian markets follow the lead of the US rallying to close out the week in the green. European indexes, however, are red across the board this morning but only down about 2% at the time of this report. US Futures point to an overnight gap down at the open ahead of personal income and consumer sentiment reports. Consider your risk carefully as we head into the weekend because anything is possible by Monday morning.

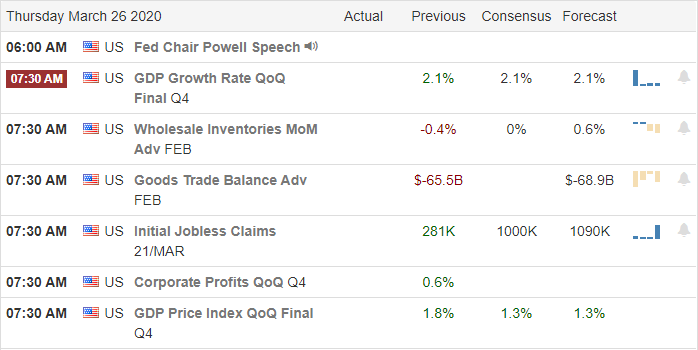

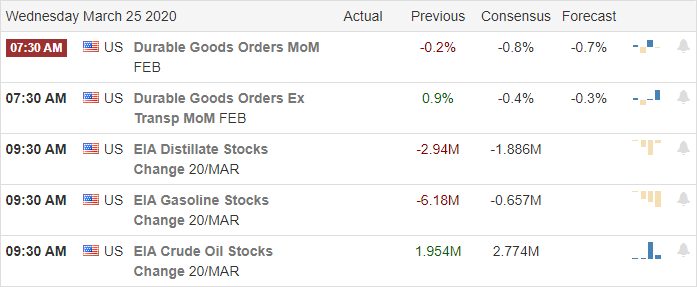

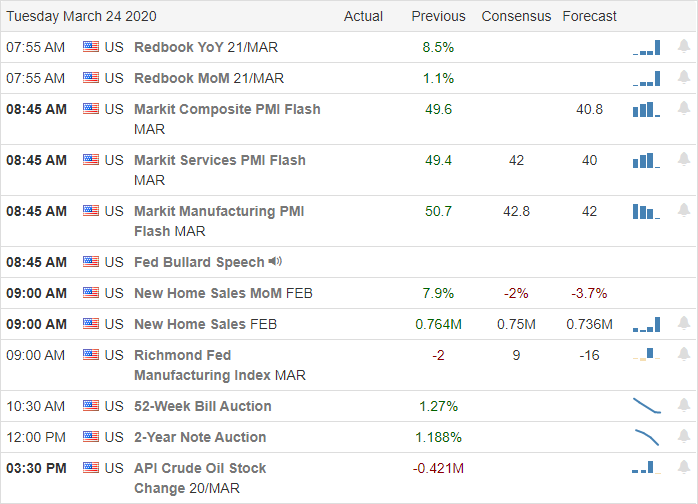

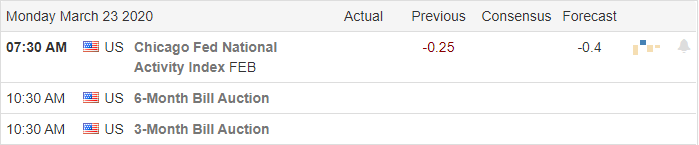

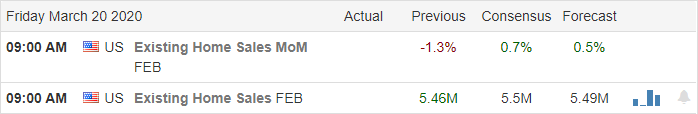

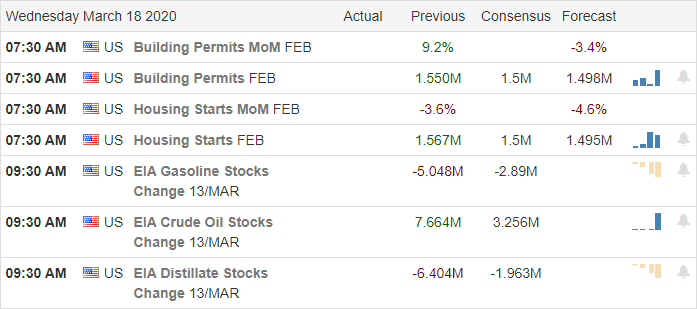

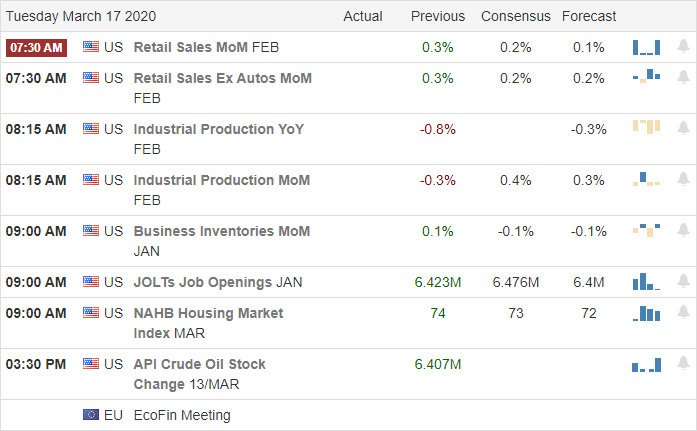

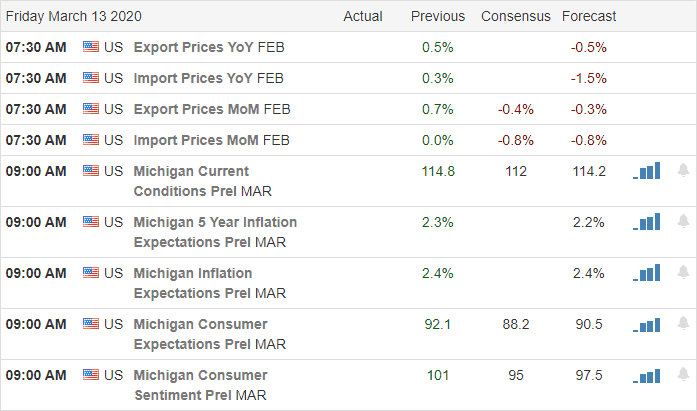

Economic Calendar

Earnings Calendar

We have a light day on the economic calendar with just over 40 companies reporting. However, the majority are small-cap companies, and I can find no particularly notable reports today.

Top Stories

Hopes are high that the House will move forward with a vote today on the 2-trillion stimulus bill. There is, however, still a chance that one or more representatives reaching for the spotlight could delay the vote into the weekend.

The US now has the grim title as the highest number of infections that will, too, continue to rise exponentially through the weekend. As of this morning, 85,625 American infections and more than 1300 have died.

The market shrugged off the record-breaking 3.2 million unemployment number to record the biggest bounce 3-day bounce off in history. To put this into perspective, unemployment topped out around 780,000 during the 2008 banking crisis.

Technically Speaking

Although the third day of the rally was fantastic, it did little to improve the technicals of the index charts. The QQQ had the best response once again, recovering its 500-day average. The SPY broke through resistance at 255, and the Dow recovered it 2018 low. The question now is, can they hold these important price supports heading into the uncertainty of the weekend. Hope that passage of the stimulus bill will undoubtedly provide a little help, but the unrelenting bad news of the virus spread will continue to weigh heavily on the minds of investors. Keep in mind it will be at least another 3-weeks before the relief checks start to reach American bank accounts. In this market, a lot can happen over the course of just one hour; 3-weeks will feel like a lifetime!

Those that rushed to by at the end of the day yesterday will be punished this morning with a nasty overnight gap down. As for me, I plan to go into the weekend, essentially flat. I won’t rule out the possibility of some quick intra-day trades, but for me holding into the weekend is a straight-up gamble that I will avoid. Be safe, my friends and have a wonderful weekend.

Trade Wisley,

Doug